On this page

Why is it so difficult to toss that dress or the shirt that you know you are not going to wear? Or give away that book that has been on the shelf forever, and you haven’t read? Why is it not easy to give up that job that you absolutely hate doing?

Though you know that giving them up is the most rational thing to do, your mind still refuses to do so. Why are we so afraid of losing something? This is because we human beings are wired that way. We try to avoid loss more than trying to pursue a similar gain. This phenomenon is popularly known as Loss Aversion. In this article, witness a few loss aversion examples where this principle is applied to modify consumer buying behavior for marketing and employee behavior and attitudes for HR.

Nobel prize-winning psychologists Daniel Kahneman and Amos Tversky, proposed the Prospect theory in the year 1979, which popularized the concept of loss aversion. Even today, Prospect theory is considered to be one of the most influential theoretical frameworks in the field of behavioral economics.

This Kanheman- Amos study found that human beings react differently to gains and losses; win and failures; basically, any positive and negative changes to our status quo. Losing something (money, an item, a job, a large deal, etc.) can be twice as painful as gaining the same thing.

For example, the pain of losing a $100 bill that you unintentionally dropped while searching your wallet can be much greater than receiving a $100 bill as a gift from someone.

Loss aversion is not limited to the emotion of losing money or any materialistic possession. It applies to every aspect of our day-to-day life. Basically, loss aversion as a principle affects human emotion - the emotion of scaling down or downsizing anything. Human beings are scared of losing anything that we “own” - be it relationships, businesses, ideas, thoughts and whatnot. For example, you would hate losing an argument in which you are discussing your favourite sport, political ideologies or something that you are passionate about.

Businesses of today are investing a lot of time and money in understanding human behaviours and how subtle aspects of organizational policies, design, rewards, recognition etc. change can greatly influence employee and customer behaviors.

Loss aversion bias applied to consumer buying behavior for marketing

We have all come across marketing campaigns that say – “Limited period offer, only for you!”, “Best price, applicable only till midnight”, “Register now to get free service for a year”, “Last chance to buy”, etc. And most of us, at some point of time in our life, have been guilty of making an impulsive purchase, in fear of missing out on a great deal.

Have you also experienced this “Fear of Missing Out” or FOMO? Don’t worry, you are not alone. 70% of the millennials experience FOMO on a regular basis, says a recent study.

FOMO is nothing but a form of social anxiety, that has its deeper roots in the principle of Loss Aversion – and invokes fear of missing out on an exciting opportunity or a deal in people.

The concept of FOMO and loss aversion has sure captured the imagination of all marketers. And no wonder every website and every brand, at some point in time or other, have tried to advertise an offer that is “ending soon” (which is mostly not!).

However, one needs to be extremely careful not to overuse loss aversion in their customer campaigns. When overused, loss aversion can lead to what is called banner blindness – i.e., customers are unlikely to click on anything that looks like an ad.

“95% of the purchasing decisions are made subconsciously,” says professor Gerald Zaltman in his book How Customers Think: Essential Insights into the Mind of the Market. Emotion is what drives customers’ purchasing behaviors he says.

Hence, to effectively use loss aversion to increase conversion rate and brand engagement requires a precise understanding of your customer behaviors, what they are afraid of losing, and why, and providing them with an appropriate solution to avoid this loss.

Here are some examples of loss aversion strategies that can help boost conversion rate and customer engagement without being pushy:

1. Share relevant data to help decision making

A Ford Galaxie Ad (as relevant it was for the ‘70s) uses facts extensively in the Ad copy for decision making

Position what value the customer gains from your product. When a customer sees the gap between what the current situation is and what he is missing out on without your product, it just works wonders.

2. Use customer loyalty programs to give a friendly nudge

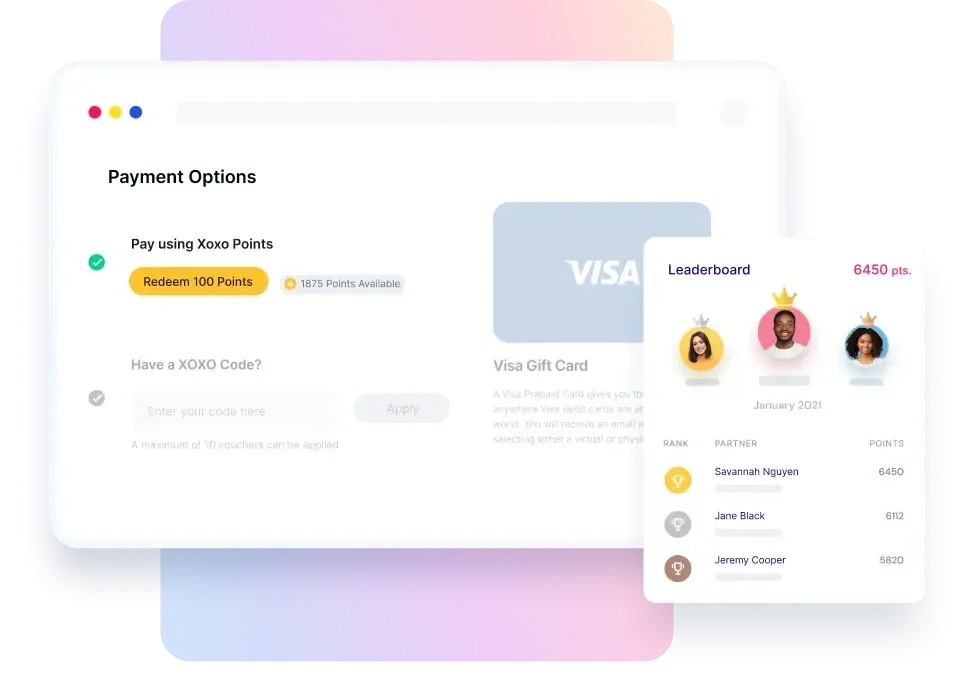

While using rewards and incentive programs with your customers, if you also set an expiry to the redemption of the same, it instils a sense of urgency amongst the customers – pushing them to take action sooner rather than later. The idea behind using rewards and incentives is to encourage customers to routinely engage in the product/ brand.

3. Create a sense of ownership

We often develop a strong bond with the things that we own. So much so that we start to overvalue the object (even more than its actual value) and hence, find it difficult to give it up. This, in terms of psychology, is called the Endowment Effect.

Slack’s free trial and conversion rate of 40% reported in 2014 is an example of capitalizing on endowment

So, when you give your customer a free trial or a free product sample, you are creating a sense of ownership to induce an endowment effect and influence them positively. They get to use the fully loaded version of the product and develop a bond so strong that they find it difficult to lose it when the trial ends – pushing them to sign-up for the product.

4. Provide with the right choices

Research shows that customers tend to choose a higher number of features when they are presented with the full-stack product – loaded with all features - and are allowed to choose what features they want to downsize at the checkout.

This feature comparison Ad copy of Volkswagen Jetta (2019) aims to diminish sensitivity towards the price.

Here the idea is to create a sense of loss aversion with the features which in turn has the power to diminish sensitivity towards the price.

5. Use customer reviews effectively

Social proofing is a great way through which your customers can feel connected to your products. So, when you introduce testimonials from other customers to which your audience can relate, it invokes a sense of missing out on something that can make a difference to them – again, pushing them towards the desired action.

Testimonials (like the one above of the Udemy business version) give social proofs for virtual business offerings

These examples are only indicative of how powerful loss aversion can be. Each organization can build their own strategies, based on what its target customers really want. When used effectively, loss aversion can be extremely powerful in influencing customer behavior.

Leveraging rewards to influence consumer behavior

While loss aversion primarily hinges on the psychological discomfort of losing something of value, integrating rewards into this concept can significantly amplify its effectiveness—especially in marketing and HR strategies. By framing rewards in a way that emphasizes potential loss instead of just gain, brands and organizations can create stronger behavioral nudges that drive consistent action.

Reward programs that reinforce retention

Traditional loyalty programs focus on the accumulation of points or perks, but adding a loss aversion layer makes them more compelling. When customers are reminded that their unused loyalty points are about to expire, or that a special offer will vanish after a set deadline, it introduces a psychological pressure to act quickly.

Example strategies:

- Expiring rewards: Create a sense of urgency by reminding users that their accumulated cashback or points will lapse if not redeemed within a specific timeframe.

This time-bound pressure leverages loss aversion and nudges users to act before they lose the benefits they’ve already earned.

- Tier downgrades: Show customers how close they are to maintaining a loyalty tier and warn them of upcoming downgrades if engagement drops.

- Limited redemption windows: Offer exclusive rewards or access for a short duration to increase urgency.

These small changes use loss framing to subtly encourage customer retention, repeat purchases, and ongoing engagement—because the idea of “losing out” on something already earned feels more painful than simply not receiving it.

Loss aversion bias applied to improve employee behaviors and attitudes

In a digital world that is becoming more and more transparent, blurring the line between personal and professional lives, employees constantly seek meaningful work and motivating rewards. Forward-thinking organizations are spending more and more time understanding employee behaviors and aligning them with organizational goals to constantly keep them motivated.

Traditional economic principles state that monetary incentives, rewards, and recognitions can be great drivers for performance and employee engagement. However, these are just extrinsic motivators and don't do justice to the larger picture of employee motivation. For eg. An employee who puts in a lot of effort into coding a product feature and delivering it well within the deadline – just to earn a hefty Amazon Coupon.

Whereas behavioral economic principles suggest that monetary rewards, salaries, and bonuses alone are not sufficient to drive employee engagement. In fact, A review of 120 years of research found that the link between salary and job satisfaction is extremely bleak, and this is true globally.

“Forget praise. Forget punishment. Forget cash. You need to make their jobs more interesting.” said Frederick Herzberg, an American psychologist.

Human beings thrive on intrinsic motivators like autonomy, sense of purpose, mastery of the subject, etc. These are the motivational factors that come from within and drive employees to do something for the sake of personal satisfaction. For eg., an Employee who delivers coding a complex product feature well within time, only because he loves to do it, and truly enjoys the learning process.

When organizations consider these human idiosyncrasies to design employee engagement programs that nudge employee behaviors towards better performance and increased motivation, it truly works wonders.

Further to this, the loss aversion phenomenon shows that people are motivated better by the fear of loss than the promise of rewards. So, effective employee programs need to be designed in such a way that they not only reward success but also have a clause to penalize failures. Research has time and again proven that limited use of penalties has driven higher productivity and effectiveness amongst employees. At times, penalties can simply mean altercated language to communicate the feeling of loss – For E.g. “You will lose your extra 5% bonus if you don't complete the project by the end of the month”.

Let’s take a look at some examples of how rewards and recognition programs can be framed in a way that it is appealing to employees’ loss aversions:

1. Constant positive feedback

Consistent, personal feedback and appreciation have a profound effect on human psychology.

When an employee’s actions are appreciated and rewarded, it automatically triggers a desire to perform the action again – in a better way. The satisfaction of receiving positive feedback can be a huge motivator, which the employees wouldn’t want to lose.

2. Implement instant gratification

Employees find value in being acknowledged for their achievement– in the form of incentives, spot awards, etc. - sooner rather than later.

While instant gratification is a huge morale boost to the achiever, it motivates others in the team to compete harder to reach their goals.

With Empuls users can send instant rewards and appreciation

3. Keep innovating, keep changing

Keep changing the rewards so that employees don’t get complacent with what is on offer.

Employees need to be intrigued, engaged, and motivated to fight for the reward. A great incentive program is one that is never static.

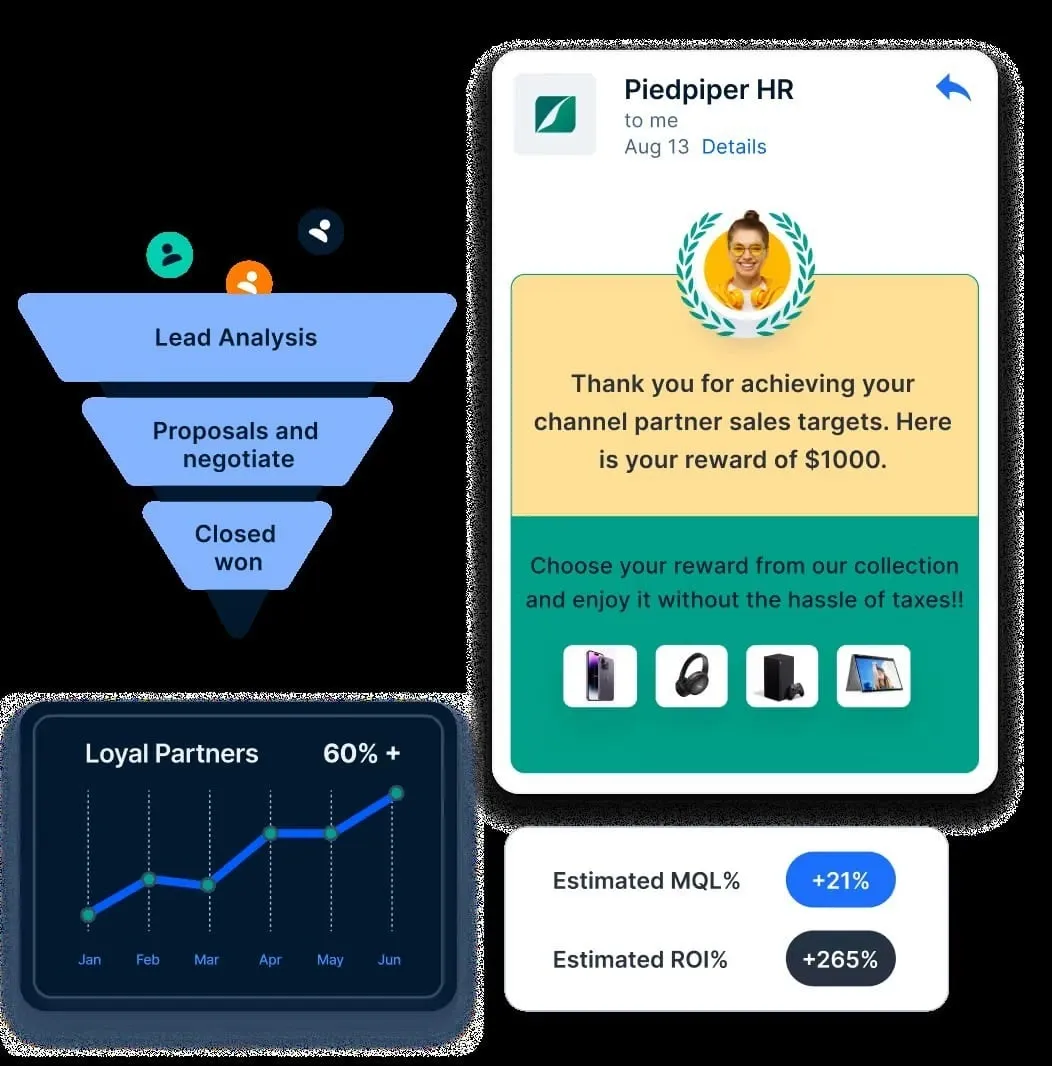

Compass uses graduating, milestone-based rewards for performance

4. Gamification

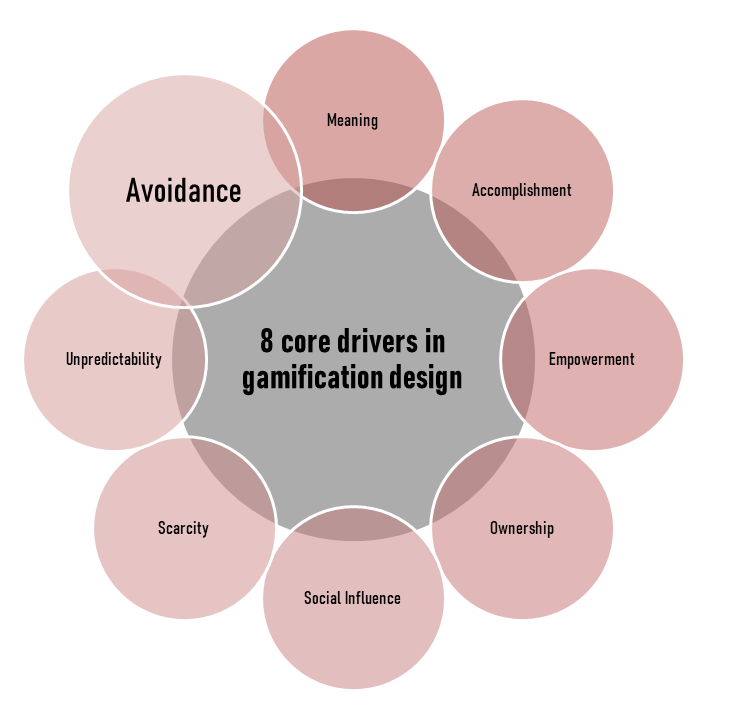

Organizations are increasingly adopting gamification techniques (like leaderboards, badges, etc.) to boost employee motivation and drive measurable results.

‘Avoidance’ of ‘loss aversion is one of the 8 core drivers in gamification design.

Gamification is known to deliver proven results like – increased engagement, improved performances, increased competition, while instilling positive behavior.

Compass uses gamification elements like leaderboards to drive performance

Using rewards and recognition programs to strategically influence employee behaviors can drive better engagement and improved performance.

Leveraging rewards to influence employee behavior

In workplace contexts, incentives don’t always have to be structured around future gains. Instead, forward-thinking companies are now experimenting with “prepaid” bonuses or rewards that employees stand to lose if performance expectations aren’t met. This flips the traditional model—motivating through potential loss rather than distant rewards.

Example strategies:

- Performance bonuses: Provide a performance bonus upfront with the clause that it will be deducted if quarterly targets aren't met.

- Gamified leaderboards: Reset performance rankings monthly or quarterly using a leaderboard, so employees are incentivized to maintain their position and not “fall behind.”

- Time-sensitive recognition programs: Offer spot awards with a redemption window, emphasizing the urgency to act before they vanish.

These tactics align with behavioral economics findings: people will work harder to retain what they believe is theirs than to earn something new.

Final thoughts

Behavioral economics principles like loss aversion play a huge role in employee or customer behaviors. While these principles can greatly influence behaviors, the idea of using these in workplaces should be to increase engagement and not invoke a sense of fear.

Rewards, recognition, and incentives when designed with behavioral economics principles, works wonders in shaping employee and customer behaviors. Understanding their needs and fears can help you design loyalty and engagement programs that can positively influence their behaviors.

Keen to know more about how to apply loss aversion to drive your customer and employee behaviors?

Connect with our experts and know how Xoxoday products help you use loss aversion to your advantage.