On this page

India’s gig economy is at a turning point. With the labour code on social security now recognizing gig and platform workers as part of the formal workforce, the country is finally extending social security for workers in India—including long-overlooked segments within the unorganised workforce. For aggregators, this shift is big: new legal responsibilities, new financial commitments, and a new expectation to support the people who power their platforms.

Under the new rules, aggregators must:

- Register with the government and classify workers correctly

- Contribute to the Social Security Fund (1–2% of turnover or up to 5% of worker payouts)

- Support worker registration on e-Shram for benefit portability

- Maintain transparent records and submit regular compliance reports

- Provide grievance redressal and clear communication on rights and benefits

As the labour code for platform workers reshapes accountability in the digital labour economy, the question isn’t just how to comply, but how to turn compliance into a competitive edge.

This blog breaks down exactly what the codes mandate, what aggregators must do, and how to elevate support for social security platform workers in a way that strengthens retention, trust, and long-term workforce loyalty.

Read more: New Labour Laws in India

Who are platform workers?

The Code on Social Security, 2020 establishes distinct categories within India's evolving workforce. Platform workers form a subset of gig workers with one key distinction: their work is mediated through digital platforms. An Uber driver, Swiggy delivery partner, Urban Company service professional, or Amazon Flex delivery agent are platform workers because a digital intermediary connects them to customers.

This distinction becomes crucial when determining which social security schemes for unorganised workers in India apply, as certain provisions specifically target platform workers and their aggregators.

Employees vs platform workers vs independent contractors

Understanding these classifications is essential for aggregators navigating the new regulatory environment, as each category carries distinct rights and obligations.

The labour code for platform workers creates a middle ground, extending social security for workers in India to platform workers without reclassifying them as employees. This approach aims to provide safety nets appropriate to the gig economy's flexible nature while maintaining the operational models that make platform businesses viable.

What constitutes an "aggregator" under the new codes?

The labour code for platform workers introduces a third critical entity: the aggregator. Aggregators are digital intermediaries or marketplaces that connect service providers (platform workers) with consumers.

Companies like Uber, Ola, Swiggy, Zomato, Urban Company, Dunzo, and similar digital marketplace operators fall under this classification. The aggregator doesn't directly employ platform workers in the traditional sense, but it controls the infrastructure, the app, the algorithm, the payment system, and often the pricing mechanism.

This legal recognition carries significant implications. Aggregators now bear specific obligations under the labour code on social security, including mandatory financial contributions to social security funds, registration requirements, and compliance reporting.

What the new labour codes mandate for platform workers

The Code on Social Security, 2020 represents a paradigm shift for India's gig economy. For decades, platform workers operated without recognition under the Payment of Wages Act (1936), Minimum Wages Act (1948), EPF Act, or ESI Act—relegated to the informal sector.

The labour code on social security now formally recognizes gig workers and platform workers for the first time, bringing them under the ambit of social security and legal protection. This landmark reform transforms a workforce that has long powered India's digital economy from invisible and vulnerable to legally protected and secured.

1. Legal recognition and protection

The Code equips gig and platform workers with essential safeguards, empowers them with portable rights, and transforms informal work into a secure, recognized, and sustainable livelihood.

- Platform workers are no longer part of the unorganized sector

- They gain formal status under Indian labour law

- This recognition is the foundation for all subsequent benefits and protections

2. Social Security Fund contributions

Aggregators are required to contribute 1-2% of their annual turnover, capped at 5% of payments made or payable to gig and platform workers, to a Social Security Fund.

- Previously, workers bore all risks themselves with no aggregator obligations

- The fund finances welfare schemes through multiple mechanisms

- Government contributions and CSR initiatives can supplement the fund

- This creates a dedicated financial pool for social security schemes for unorganised workers in India

3. Comprehensive social security benefits

Platform workers are now eligible for government-notified social security benefits such as life and disability cover, health and maternity benefits, pension, accident insurance, and crèche facilities.

- Workers once depended solely on voluntary schemes or CSR initiatives

- No statutory entitlement to PF, ESI, pension, or insurance existed before

- Now they become part of a formal social security framework

- Social security for workers in India now extends to platform workers

4. Portable benefits across platforms

Platform workers can continue to enjoy their social security benefits even when switching jobs or platforms, ensuring continuity and security.

- Each worker receives a unique Aadhaar-linked ID generated through registration on e-Shram.

- Benefits are portable across all platforms

- Workers can juggle multiple platforms simultaneously without losing coverage

- Benefits continue seamlessly when moving from one aggregator to another

- This solves one of the gig economy's biggest challenges—benefit fragmentation

5. National registration database

Platform workers can self-register on the government e-Shram portal, creating a comprehensive national database.

- Enables efficient benefit administration

- Supports social security delivery

- Facilitates skill development programs

- Provides data for evidence-based policy making

- Creates visibility for a historically invisible workforce

6. Grievance redressal mechanisms

The appropriate government may set up a toll-free helpline, call center, or facilitation center to address worker grievances and ensure timely support.

- Previously, platform workers had no access to formal labour laws

- No structured grievance redressal mechanism existed

- Now workers have an institutional avenue to voice concerns and seek resolution

- This creates accountability for aggregators and government agencies

Understanding these mandates is only the first step. Aggregators must now navigate their specific obligations to remain compliant under the new framework.

Core obligations for aggregators

The labour code on social security doesn't just extend benefits to platform workers—it places explicit compliance requirements on aggregators. These obligations are mandatory, time-bound, and carry legal consequences for non-compliance.

Here's what every aggregator must know and implement:

Consequences of non-compliance

While specific penalties will be notified by state governments, aggregators should anticipate:

- Financial penalties for missed contributions

- Operational restrictions or suspension

- Legal proceedings under the Code on Social Security, 2020

- Reputational damage affecting worker recruitment and customer trust

- Potential litigation from workers seeking benefits

These obligations represent the baseline. But compliance alone doesn't create competitive advantage—execution does. This is where a structured compliance approach becomes essential for aggregators.

Aggregator compliance checklist under the labour code on social security

The new labour framework places clear and enforceable responsibilities on aggregators, reshaping how platform workforces are managed and protected. To remain compliant, and to support the broader shift toward structured social security for workers in India, aggregators must ensure the following actions are in place:

- Register as an aggregator with the appropriate government authority: Registration is now a legal prerequisite for operating any digital platform that facilitates gig or platform work, forming the basis for all subsequent compliance activities.

- Contribute to the Social Security Fund: Allocate 1–2% of annual turnover, capped at 5% of payouts made to platform workers, to finance social security schemes for unorganised workers in India.

- Facilitate platform worker registration on the e-Shram portal: Support workers in obtaining Aadhaar-linked unique IDs, ensuring their access to portable social security benefits across multiple platforms.

- Maintain accurate and comprehensive worker records: Document worker identity, engagement history, task volumes, payouts, and contribution calculations to meet inspection and audit requirements.

- Submit mandatory compliance reports on time: Provide periodic updates to government authorities on worker numbers, contributions made, and compliance status—an essential part of the labour code for platform workers.

- Establish an internal grievance redressal mechanism: Create clear, accessible channels for platform workers to raise concerns, aligned with government guidelines for grievance facilitation.

- Communicate rights, benefits, and processes transparently: Ensure workers understand their entitlements, know how to access benefits, and receive updates about contributions and support services.

How aggregators can turn labour code compliance into a competitive advantage

Compliance with the labour code on social security is mandatory—but it’s no longer enough to stand out in a crowded platform economy. Platform workers can shift between multiple aggregators, often choosing the ones that offer more stability, support, and recognition. Xoxoday’s deskless workforce engagement solutions help aggregators go beyond statutory obligations and build a differentiated worker value proposition.

1. Managing worker complexity with a unified system

The challenge: Platform workforces are diverse, distributed, and constantly changing. Traditional HR tools cannot track eligibility, benefits, and engagement for thousands of platform workers with varying levels of activity.

Xoxoday’s solution:

- A single system that accommodates different worker categories, including high-churn platform workers.

- Automated eligibility tracking for social security schemes for unorganised workers in India.

- Centralized visibility into benefit utilization and worker participation.

Why this matters: Aggregators reduce administrative overhead while ensuring every platform worker receives the correct benefits under the social security framework.

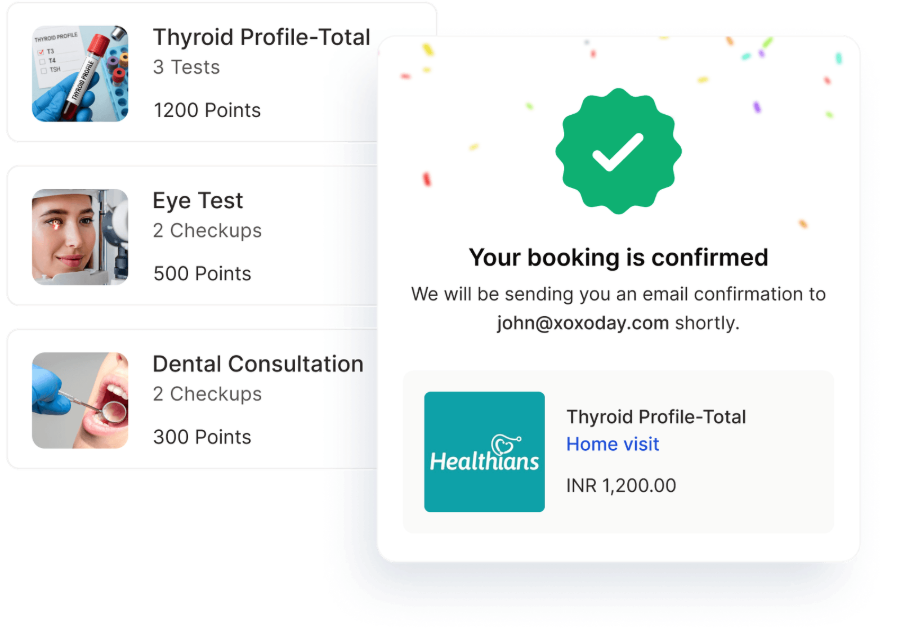

2. Delivering wellness benefits beyond statutory minimums

The challenge: The labour code for platform workers mandates basic protections, but platform workers face additional stressors, irregular hours, limited access to preventive care, and physically demanding work.

Xoxoday’s solution:

- Preventive health check-ups for all workers

- Mental health support and wellness resources

- Fitness and lifestyle benefits delivered digitally

- Access to comprehensive insurance options

Why this matters: Better health directly improves attendance, performance, and loyalty, creating meaningful differentiation beyond compliance.

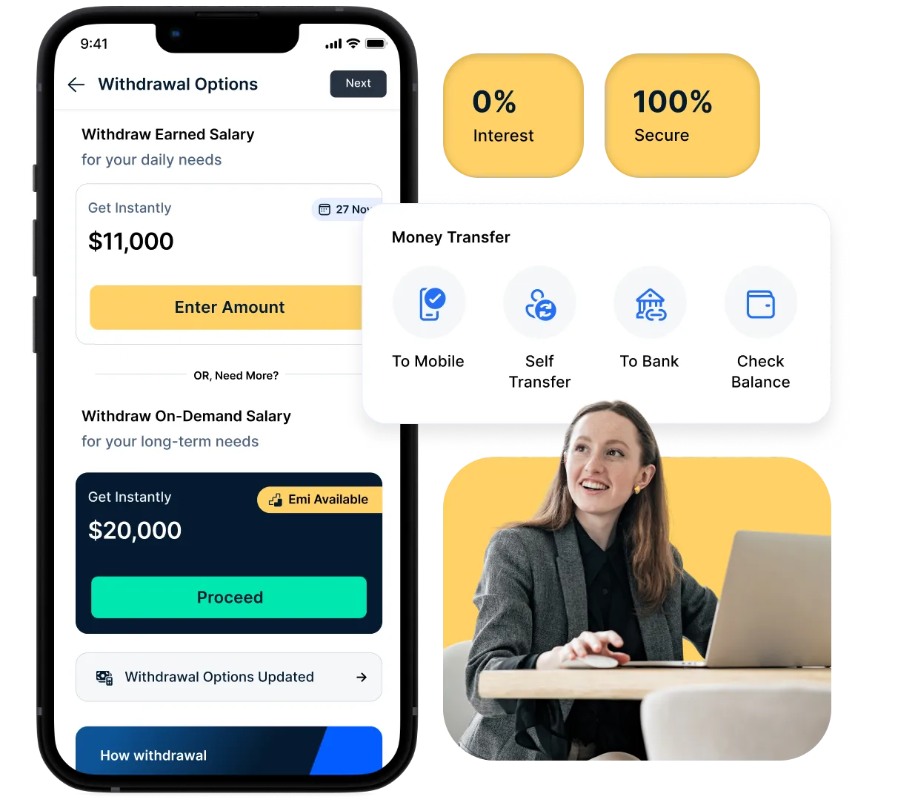

3. Supporting financial stability for gig and platform workers

The challenge: Platform workers experience unpredictable earnings, making financial stress one of the biggest drivers of churn.

Xoxoday’s solution:

- Early access to earned income between pay cycles

- Zero liability for aggregators

- A structured alternative to high-interest loans

Why this matters: Financial wellness is a core component of social security for workers in India, and offering flexible access to earnings signals that the aggregator truly understands worker realities.

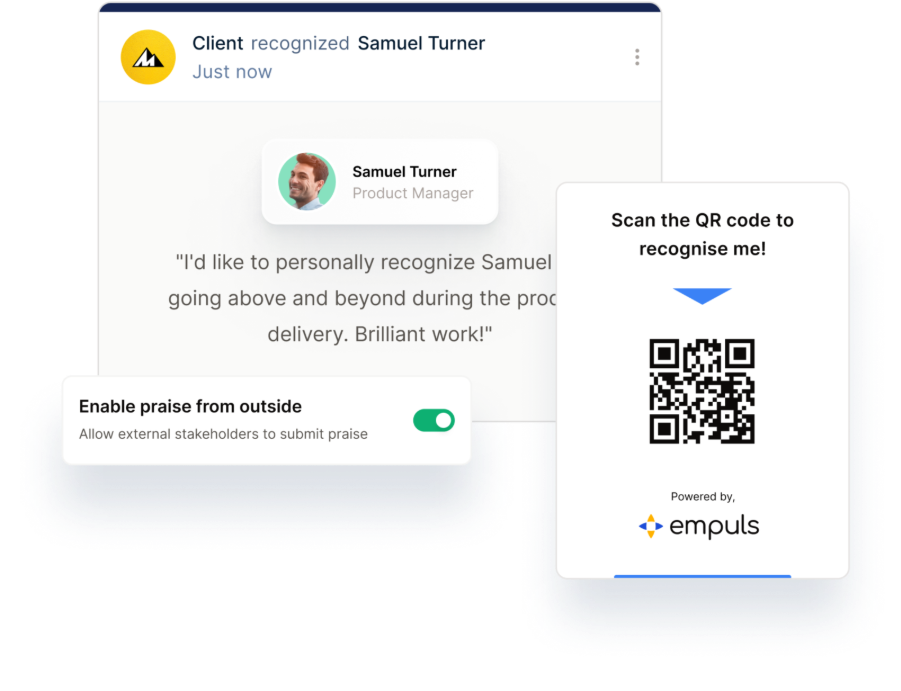

4. Recognizing and rewarding platform worker performance at scale

The challenge: Platform workers operate independently with little visibility or acknowledgment. This often leads to disengagement and high turnover.

Xoxoday’s solution:

- Digital recognition programs for distributed workforces

- Rewards for performance, customer ratings, milestones, and safety

- Large redemption marketplace for everyday needs

Why this matters: Recognition creates emotional stickiness—an essential advantage when workers compare multiple platform options.

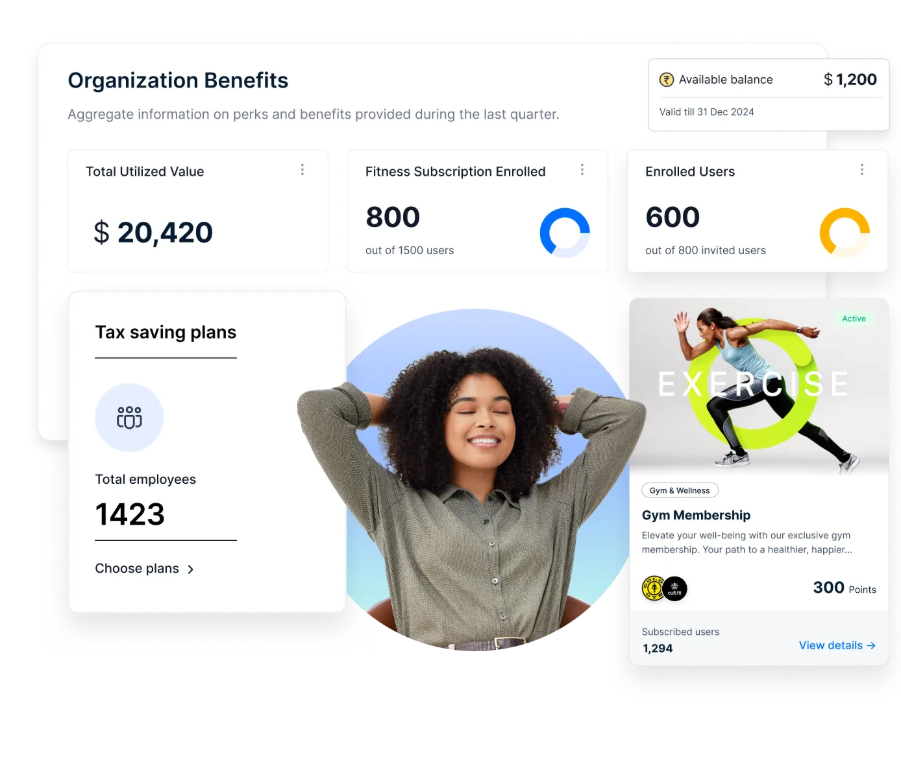

5. Expanding benefits and perks for real competitive differentiation

The challenge: Minimum wages mandated under the Code ensure fairness but do not create loyalty or preference in the gig marketplace.

Xoxoday’s solution:

- Lifestyle spending accounts tailored to platform worker needs

- Exclusive discounts across daily-use categories

- Flexible benefits that supplement statutory entitlements

Why this matters: Total rewards influence worker decisions more strongly than marginal pay differences, helping aggregators retain a reliable workforce.

By addressing the practical needs of platform workers—wellness, financial stability, recognition, and simplified access to benefits—aggregators can transform compliance from a burden into a strategic advantage. This creates a more resilient workforce and positions the platform as a preferred choice in an increasingly competitive gig economy.

Conclusion

The labour code on social security creates a new baseline for platform worker protection in India—but compliance alone won’t set aggregators apart. Those who invest in worker wellness, financial stability, and meaningful engagement will build stronger loyalty and stand out in a competitive gig marketplace.

👉 Talk to our culture specialists: Get in touch