On this page

With the Labour Code 2025 set to reshape how Indian companies structure compensation, HR and compensation leaders must begin preparing for a compliant salary structure in India as per labour law. The new wage definition, where basic pay, dearness allowance, and eligible inclusions must form at least 50% of total CTC, will directly impact take-home pay, PF contributions, gratuity, and employee sentiment. Navigating this transition requires a structured approach that balances statutory requirements with employee experience and clear communication.

What this step-by-step guide covers

- Audit current salary structures to identify non-compliant roles and allowance-heavy pay mixes.

- Model impacts and scenarios to understand take-home changes, PF/gratuity increases, and tax implications.

- Design compliant templates that meet the 50% wage rule while maintaining internal equity.

- Implement and communicate changes with clarity, alignment, and employee-first messaging.

- Monitor and optimize compliance through regular audits, benchmarking, and proactive corrections.

This guide explains:

- How to apply each step

- How to prepare for employee reactions, and

- How to coordinate with finance, legal, and payroll teams to avoid penalties or backdated liabilities.

You’ll also learn how organizations can use a unified benefits and engagement platform to soften take-home impact, strengthen financial and wellbeing support, and elevate employee value proposition during this transition.

Why restructure now?

With the implementation of the Code on Wages, 2019 — now fully part of the Labour Code 2025 regime in India, the definition of “wages” has fundamentally changed. Under the new law, wages are defined as basic pay + dearness allowance (DA) + statutory inclusions, and this must make up at least 50% of the total cost to company (CTC).

Any allowances or exclusions (e.g., bonus, overtime, non-statutory perks) are only permitted if they don’t push the “excluded” portion beyond 50% of total CTC. If exclusions exceed that threshold, the excess amount becomes part of “wages,” triggering higher statutory obligations.

That means existing salary structures across organizations require urgent revision. Many CTC-based packages that previously optimized take-home pay with high allowances now risk becoming non-compliant, potentially leading to steep consequences.

Penalties for violations can include fines (up to ₹1.5 lakh per offence), prosecution, and retrospective liabilities such as unpaid Provident Fund (PF) dues and gratuity obligations. Here’s how it would look:

For HR, compensation & benefits, and payroll leaders, this isn’t just a compliance exercise; it’s a critical business risk and an opportunity to future-proof salary design before the enforcement deadline hits.

Given this backdrop, now is the ideal moment for HR and payroll teams to begin a structured review, audit current payrolls, model impact scenarios, and design a compliant salary structure format as per labour law that balances statutory obligations with employee experience.

Read our detailed breakdown of the new labour laws and see how you can deliver employee perks, benefits and wellbeing — all aligned with the 2025 codes.

Explore the new labour laws & benefits platform →

Step-by-step guide to restructuring salaries under the labour code 2025

As organizations prepare for the new wage definition to take effect, HR and compensation leaders need a clear, practical sequence of actions to redesign a salary structure in India as per labour law. The goal is to stay compliant, minimise take-home impact, and manage employee experience during transition. The steps below offer a structured approach to get started.

Step 1: Audit current salary structures

Begin by establishing a clear baseline of how your current pay mix aligns with the mandated 50% wage requirement. This helps you quantify PF, gratuity, and take-home impact before redesigning a salary structure in India as per labour law.

- Flag employees falling below the 50% threshold—junior roles usually have the widest gaps due to high allowances.

- Review the last six months of pay slips to identify patterns in special allowances, variable components, or reimbursements that may need reclassification under a compliant salary structure as per labour law.

- Segment employees by band—entry-level (high-risk), mid-level, and senior—to prioritize where restructuring effort is most urgent.

or,

Use a simple Excel check: =IF((B2+C2+D2)/A2<0.5,"Non-compliant","OK") to quickly tag at-risk profiles.

Loop in finance and payroll early to estimate PF and gratuity impact, ensuring you avoid backdated liabilities from misclassified wages when transitioning to a salary structure format as per labour law.

Step 2: Model impacts and scenarios

Once you identify non-compliant roles, the next step is to quantify how the revised wage definition will affect PF, gratuity, take-home pay, and overall payroll cost.

Table for salary bands:

This helps HR and finance align on a realistic, employee-friendly transition plan before finalizing a salary structure in India as per labour law.

- Recalculate PF and gratuity using the corrected wage base, keeping in mind that higher basic pay increases statutory contributions while reducing take-home pay temporarily.

- Build comparison scenarios that show the trade-offs clearly—for example: increased PF balances vs. reduced monthly in-hand salary. This makes it easier to communicate changes to employees later.

- Model the average take-home dip across bands; early industry estimates show a 10–15% reduction for many employees, especially those with allowance-heavy packages.

For instance: a ₹10 lakh CTC employee may see PF rise by ₹24,000 per year while take-home reduces by roughly ₹10,000–12,000 per month.

- Include tax savings projections from higher standard deductions to balance the narrative and reinforce long-term benefits.

- Align scenarios with finance to validate cost impact and avoid unintended payroll inflation when implementing a compliant salary structure as per labor law.

- Test phased-transition options—e.g., increasing basic pay in quarterly increments—to preserve morale and reduce shocks, especially high-risk employee groups.

Ensure all modelling aligns with state-specific floor wages, so your final salary structure format as per labor law remains compliant across locations.

Step 3: Design compliant salary templates

With impact scenarios validated, the next step is to build new templates that meet the 50% wage rule while keeping compensation predictable and fair across bands. This ensures every role transitions to a compliant salary structure in India as per labor law without disrupting internal equity.

- Restrict allowances to statutory or role-linked components such as HRA, conveyance, medical reimbursements, and performance pay. The goal is to avoid excessive exclusions that violate the salary structure as per labor law.

- Use differentiated templates by level—e.g., junior employees with a 50% basic ratio (to manage take-home) and senior roles with 55% basic (optimizing gratuity and long-term savings).

- Rebuild variable pay structures to ensure incentives do not distort the wage ratio or create accidental non-compliance.

- Test templates across multiple months of simulated payroll to evaluate PF, gratuity, tax liability, and take-home impact.

- Create salary slips that clearly show wage components to minimize confusion when employees compare old versus new structures.

Standardize a salary structure format as per labour law across locations, ensuring consistency even where state-specific wage floors vary.

Step 4: Implement and communicate changes

Once compliant templates are ready, rollout and communication become critical. Employees will notice immediate changes in take-home pay, so HR must manage the transition carefully while aligning payroll systems, contracts, and internal messaging with the salary structure in India as per labour law.

- Begin implementation in Q1 2026 to align with expected enforcement timelines and give teams enough space to resolve payroll or system-level issues.

- Update offer letters, employment contracts, and payroll rules to reflect the revised wage definition and new component splits.

- Reconfigure HRIS and payroll engines, so PF, gratuity, bonus eligibility, and overtime are calculated on the corrected wage base.

- Prepare simple, transparent communication scripts explaining why basic pay has increased, why PF contributions are higher, and why take-home may dip temporarily.

- Frame the narrative around long-term financial wellbeing—higher PF, increased gratuity, and better retirement security—rather than focusing on reduced in-hand salary.

- Use an FAQ format for employees addressing PF, gratuity, bonus eligibility, tax impact, and salary revisions to reduce one-on-one queries.

- Coordinate with payroll vendors and banks for API updates, revised deduction files, and prevent miscalculations during the transition.

Involve legal teams early to update indemnity clauses and contractor templates so all worker groups, permanent, fixed term, and gig, follow a compliant salary structure as per labour law.

Step 5: Monitor and optimize compliance

After implementation, ongoing monitoring is essential to ensure your redesigned salary structure continues to stay compliant as per labour law. Wage ratios can drift over time due to increments, variable pay, or new allowances, so HR must treat this as a continuous compliance function rather than a one-time project.

- Conduct quarterly internal audits using HRIS or payroll data to ensure wage ratios remain at or above the 50% threshold across all bands.

- Track how take-home changes affect retention, especially among junior roles that may experience the steepest dips. Early trend monitoring helps refine communication and future compensation strategies.

- Benchmark your new salary structure against peer organizations to ensure competitiveness while staying compliant with the salary structure in India as per labour law.

- Revisit role-based templates annually to ensure increments don’t accidentally shift compensation into a non-compliant range.

- Use e-Shram and other government-aligned systems to verify worker records, especially contract, gig, and platform workers covered under the broader social security provisions.

- Make adjustments proactively when state-specific floor wages update to ensure your standardized salary structure format as per labour law remains aligned across locations.

Review vendor and contractor payrolls regularly to reduce shared compliance risks that may arise from misclassified wages.

See how Empuls Perks & Benefits works →

How Xoxoday supports HR leaders navigating the new labour code shift

As organizations redesign salary structures to comply with the Labour Code 2025, HR and compensation leaders will need tools that go beyond statutory alignment. Take-home dips, financial stress, morale fluctuations, and the need for a unified employee experience all emerge as practical challenges once a compliant salary structure in India as per labour law is implemented.

This is where Xoxoday steps in, built in India, built for Indian companies, and deeply attuned to the realities of Indian payroll, benefits, and workforce structures. With a tech-first approach, Xoxoday has always been ahead of regulatory and operational shifts, designing solutions that simplify complexity for HR, finance, and people leaders.

As a single platform for powering rewards, incentives, loyalty, and employee engagement, Xoxoday enables businesses to strengthen the emotional, physical, and financial wellbeing of their workforce without adding fixed payroll costs.

1. Meeting preventive healthcare requirements efficiently

The labour code mandates annual health check-ups for workers above the age of 40. However, forward-looking aggregators recognize that workforce wellbeing cannot be age-gated. Platform workers of all ages face physical strain, irregular schedules, and high stress: factors that directly impact long-term productivity, safety, and service quality.

Rather than treating preventive healthcare as a minimum compliance requirement, aggregators can adopt a more inclusive approach that extends wellness support to all platform workers, regardless of age. This not only aligns with the broader intent of social security for workers in India but also reinforces the message that every worker’s health matters to the long-term success of the platform.

Through a unified wellness infrastructure, aggregators can provide:

- Annual check-ups

- Teleconsultations and OPD coverage

- Fitness and preventive-care programs

- Mental wellbeing support

This helps organizations fulfill mandatory requirements while strengthening overall workforce wellbeing at a time when take-home pay may be impacted.

2. Supporting financial stability during take-home changes

Reduced in-hand salary is one of the most immediate employee concerns under the new wage definition. Xoxoday offers financial wellness tools that help maintain stability without increasing fixed payroll costs:

- Access to earned wages before payday

- Tax-saving benefits administration cards

- Budgeting and financial wellness support

- Flexible allowances that optimize net pay

These features give employees more control over cash flow when contributions to PF and gratuity rise.

3. Strengthening total rewards without raising CTC

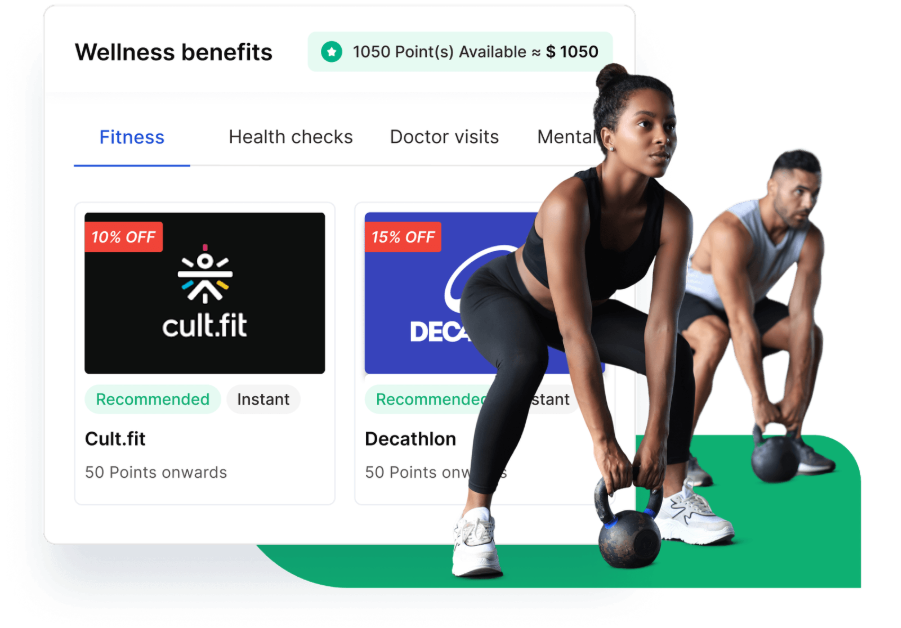

Once a salary structure in India as per labour law is applied, organizations have limited room to adjust compensation. Xoxoday helps HR teams improve perceived value through:

- Lifestyle spending accounts

- Discount marketplaces that reduce out-of-pocket expenses

- Customizable recognition programs

This allows organizations to reinforce their employee value proposition even when wage restructuring restricts flexibility.

4. A single platform that reduces administrative load

With multiple changes occurring simultaneously, wage restructuring, policy updates, communication rollouts, HR leaders need operational simplicity. Xoxoday’s tech-first platform consolidates wellness, financial benefits, engagement, rewards, and communication into one system, helping teams stay agile and compliant as requirements evolve.

Schedule a call with our experts now!

Wrapping up

Salary restructuring under the Labour Code 2025 is not just a compliance exercise—it is a strategic shift in how organizations manage compensation, financial wellbeing, and employee experience.

By approaching this transition with structured audits, clear communication, and data-backed modelling, HR leaders can ensure compliance while maintaining workforce trust. Strengthening total rewards, wellbeing benefits, and financial support mechanisms becomes essential as employees adjust to the new wage structure.

Organizations that prepare early will navigate the change smoothly and position themselves as forward-thinking, transparent, and employee-centric in the new labour landscape.

FAQs

What is the new salary structure?

The new salary structure under the Labour Code 2025 requires that basic pay + dearness allowance (DA) + eligible inclusions make up at least 50% of an employee’s total CTC. Allowances such as special allowance, bonuses, overtime, and certain reimbursements cannot exceed the remaining 50%. Any excess is added back into “wages,” which impacts PF, gratuity, bonus eligibility, and take-home pay. This forms the foundation of a compliant salary structure in India as per labour law.

What is the basic salary structure?

Under the new rules, basic salary—along with DA and specific statutory inclusions—must form 50–55% of the total compensation. This ensures PF, gratuity, and other statutory contributions are correctly calculated. Employers must design a salary structure as per labour law where the basic component is meaningful, consistent, and aligned with the unified wage definition.

How much is the new salary structure?

The structure varies by organization, but the guiding rule is fixed: 50% of CTC must qualify as wages. This typically increases basic pay and reduces allowance-heavy structures. For many employees, the shift results in higher long-term benefits (PF, gratuity) but a short-term dip in take-home pay. Companies must therefore adopt a salary structure format as per labour law tailored to their job bands, geographies, and CTC ranges.

How to calculate the salary structure?

To check compliance, calculate:

(Basic + DA + statutory inclusions) ÷ Total CTC × 100

- If the result is <50%, the structure is non-compliant and must be rebalanced.

- If ≥50%, it meets the new wage definition.

This calculation helps HR teams restructure pay mixes accurately and build a compliant salary structure in India as per labour law.