On this page

Understanding the auto sales commission percentage is essential for car sales reps and dealership managers who want clarity on how earnings are structured and how competitive different markets really are. While commission plans vary by dealership, brand, and pay philosophy, most regions follow recognizable percentage bands tied to the front-end gross profit of each vehicle.

Here’s how commission percentages typically break down around the world:

- United States & Canada: 20–30% of gross profit per vehicle

- Western Europe: 15–25% of gross profit per vehicle

- Central/Eastern Europe: 15–22% of gross profit per vehicle

- India: 10–20% equivalent of per-vehicle gross for frontline staff

- China: Lower headline percentages, but higher reliance on salary + performance bonuses

- ASEAN-6 (e.g., Thailand, Indonesia): Low-to-mid-teens percentage equivalent on unit margins

These numbers show how compensation models differ globally, but the mechanics of calculating commissions, bonuses, and earnings remain similar. To understand how dealerships determine payout accuracy and what impacts real monthly income, let’s explore the standard commission structures for car sales reps.

Commission structure for car sales reps

A car dealership’s compensation model is built around performance, margin control, and sales volume, which is why most US dealerships still rely heavily on auto sales commission rather than fixed salary alone. While each store may adapt its own structure, most compensation plans fall into a few recognizable formats that determine how much a sales rep earns per vehicle sold.

1. Front-end commission based on gross profit

The most common form of automotive sales commission is front-end commission, where reps earn a percentage of the gross profit on each car. Instead of calculating commission on the vehicle’s sticker price, dealerships calculate earnings on the profit margin — meaning high-margin transactions create higher payouts.

Across US dealerships, front-end commissions typically range from 20% to 30% of the gross profit, though high-performing or luxury dealerships may go above this range for experienced reps.

2. Back-end commission from F&I products

In addition to the profit on the vehicle itself, many reps receive back-end commissions for selling finance and insurance (F&I) add-ons. These may include extended warranties, protection plans, GAP insurance, and aftermarket accessories. Although these products often have smaller margins individually, they can meaningfully boost a salesperson’s overall income — especially in dealerships where add-on penetration is a strong focus.

3. Flat-rate commissions for certain models

Some dealerships use flat-rate commissions on slower-moving inventory, low-margin cars, or heavily discounted deals. Flat rates often range from $50 to $200 per vehicle, depending on dealer policy. While this reduces variability, it also limits earning potential — useful for dealerships that want tighter control over margin.

4. Salary + commission hybrid models

US dealerships increasingly adopt hybrid compensation plans that include a modest salary plus variable commission. This approach helps reduce income volatility for new reps, improves retention, and supports more predictable staffing. For managers, hybrid models can stabilize performance expectations, especially in lower-volume markets.

5. Tiered or volume-based commission systems

To push higher performance, dealerships often introduce tiered structures where commission rates increase once a rep hits specific volume milestones. For example:

- 10–12 cars/month = base commission

- 13–15 cars/month = higher rate

- 16+ cars/month = top-tier incentive

This rewards reps who consistently exceed their monthly quota and encourages sustainable growth in both new and used car sales.

6. Draw systems (recoverable or non-recoverable)

Some dealerships offer a draw — an advance against future commission earnings — to help reps manage slow months. Recoverable draws must be paid back from later commissions; non-recoverable draws act like a guaranteed minimum. These systems support new hires and stabilize earnings during off-season sales cycles.

Dealerships often struggle to manage these varied structures manually. Empuls automates every layer of auto sales commission, from gross-profit calculations to tier-based incentives, bonuses, and F&I add-ons, ensuring accurate payouts and complete transparency for both reps and managers.

Schedule a call now!

Indicative auto sales commission percentage by region (2025)

Typical auto sales commission percentage by region in 2025 can be summarized as indicative bands based on gross profit per vehicle, not sale price.

These are indicative, dealership-specific plans can differ widely, and many stores also stack spiffs, F&I bonuses, and volume targets on top of these core percentage bands.

With the commission structure clarified, the next step is understanding how dealerships actually calculate commissions and bonuses for each vehicle sold. Let’s break that down.

Calculating auto sales commission percentage and bonuses

Understanding exactly how dealerships calculate compensation helps car sales reps anticipate earnings and enables managers to design fair, scalable, and transparent pay plans. While every dealership has its own policies, most US auto retailers use variations of the formulas below to determine auto sales commission payouts.

1. Standard commission formula (based on gross profit)

Most dealerships calculate commission using:

Commission = Gross Profit × Commission Rate

Where:

- Gross Profit = Selling Price − (Dealership Cost + Reconditioning + Fees)

- Commission Rate typically ranges from 20% to 35% in most US dealerships.

Example

- Selling price: $31,000

- Dealership total cost: $27,500

- Gross profit: $3,500

- Commission rate: 25%

Commission = $3,500 × 0.25 = $875

This shows how margin—not sticker price—determines earnings.

2. Mini-deal commission formula (for low-margin sales)

When a car is sold at little or no profit, dealerships use a “mini-deal” to ensure the rep still earns something.

Mini Commission = Flat Rate (set by dealership)

Common US mini-deal payouts range from $100 to $300.

Example

If a car sells at a loss or with $0 gross profit:

Mini Commission = $150

This keeps reps compensated even when high discounts or promotions reduce profit.

3. Back-end (F&I) commission formula

Back-end products—extended warranties, GAP insurance, protection plans—often significantly boost automotive sales commission earnings.

F&I Commission = F&I Gross Profit × F&I Commission Rate

Typical F&I commission rates: 5–15% for reps (higher for F&I managers).

Example

- F&I gross profit: $1,200

- Commission rate: 10%

F&I Commission = $1,200 × 0.10 = $120

This adds on top of the front-end commission.

4. Volume bonus formula (tiered commissions)

Dealerships often reward higher monthly volume with higher commission rates or bonus payouts.

Volume Bonus = Bonus Per Unit × Units Sold (beyond target)

Example

- Bonus per unit above 12 cars: $75

- Rep sells 15 cars

Excess units = 3

Volume Bonus = 3 × $75 = $225

Some dealerships also increase commission rates once reps cross thresholds (e.g., 16+ units/month).

5. Hybrid salary + commission formula

For dealerships using a mixed compensation approach:

Total Pay = Base Salary + (Gross Profit × Commission Rate)

Example

- Base salary: $2,500/month

- Gross profit across all deals: $10,000

- Commission rate: 15%

Commission = $10,000 × 0.15 = $1,500

Total monthly pay = $2,500 + $1,500 = $4,000

This model reduces pay volatility while still rewarding performance.

6. Draw-against-commission formula

A draw is an advance that reps repay through future commissions (recoverable) or keep regardless (non-recoverable).

Actual Commission Earned = Commission − Draw Amount

Example (Recoverable Draw)

- Draw: $2,000/month

- Commission earned: $1,500

Actual Income = $2,000 (paid), but $500 carried forward as owed draw

Example (Non-Recoverable)

Rep simply keeps the $2,000 even if commissions fall short.

7. All-in monthly income formula (complete model)

Dealership managers often calculate true monthly earnings like this:

Total Monthly Income = Front-End Commission

- Back-End Commission

- Volume Bonuses

- Spiffs

- Base Salary (if applicable)**

This provides an accurate picture of a rep’s take-home earnings in a month.

Example

- Front-end commissions: $3,200

- F&I commissions: $400

- Spiffs: $250

- Volume bonus: $300

Total = $3,200 + $400 + $250 + $300 = $4,150

Designing pay plans for reps, managers, or hybrid roles? Get a ready-to-use cheat sheet covering formulas, structures, and role-based plans to help you build smarter, more transparent compensation models.

Download The Free Cheat Sheet →

Now that you know how commissions and bonuses are calculated, let’s wrap up with the key insights dealers and reps should remember — and how Empuls supports modern automotive compensation models.

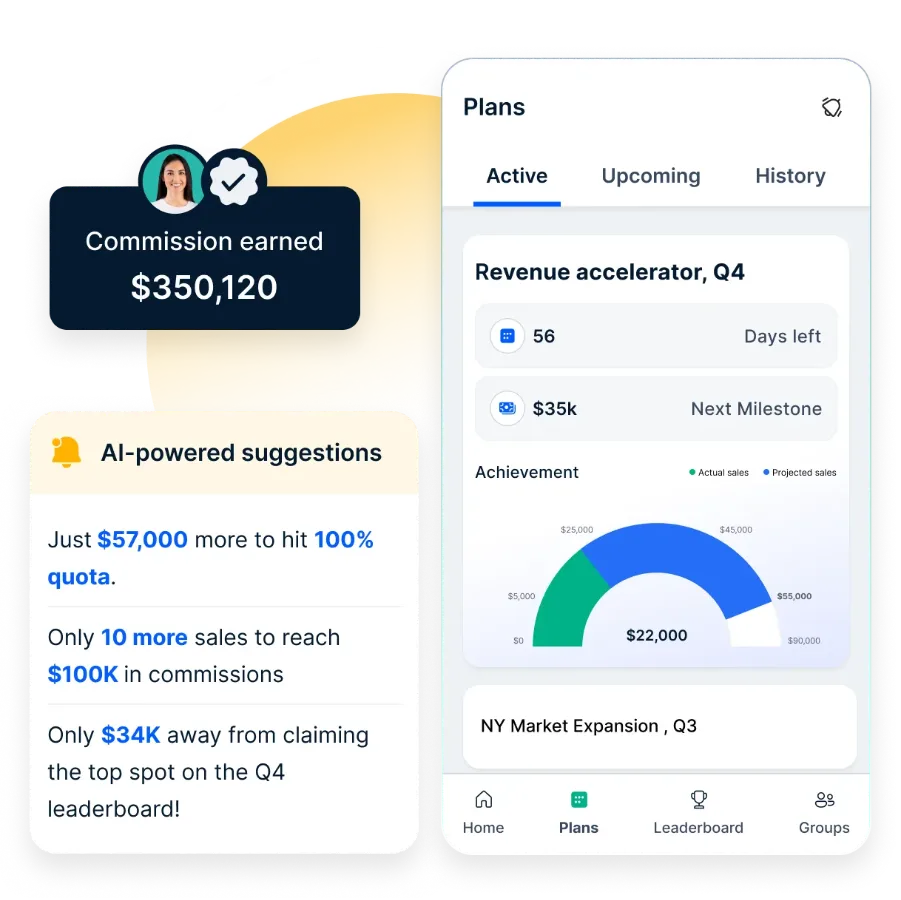

How Empuls automates auto sales commission percentages

Empuls removes the complexity of dealership compensation by automating every layer of auto sales commission percentages and making payouts accurate, fast, and transparent.

- Automates gross-profit calculations: Front-end commissions update instantly based on real deal data.

- Applies tiered bonuses automatically: Commission rates increase as reps hit volume goals.

- Handles F&I payouts: Warranties, protection plans, and add-ons are calculated in real time.

- Supports flat-rate and hybrid plans: Mini-deals, salary + commission, and draw systems are fully configurable.

- Provides real-time dashboards: Reps track earnings live; managers see cost and performance clearly.

- Reduces disputes and delays: Automation eliminates manual errors and mismatched numbers.

Empuls makes dealership commissions simple, accurate, and fully automated — so reps stay motivated and managers stay in control.

Stop juggling spreadsheets and manual math. With Empuls, dealerships automate commission rules, eliminate payout disputes, and give reps real-time visibility into their earnings. See how automation transforms compensation accuracy and performance.

Book A Live Demo →

Wrapping up

Auto dealerships use a mix of gross-profit commissions, F&I bonuses, tiered incentives, and hybrid salary plans to motivate performance. While commission rates vary widely, the structure you choose—combined with clear calculations and transparent reporting—directly impacts rep motivation and dealership profitability. With automated tools like Empuls, dealerships can simplify payouts, reduce errors, and give sales reps the clarity they need to sell confidently.

FAQs

What is the commission rate for auto sales?

Most US dealerships pay car salespeople a commission based on 20% to 35% of the front-end gross profit per vehicle. High-volume stores or luxury dealerships may offer higher rates, while low-margin deals often default to flat “mini” commissions.

What percentage of car sales go to the salesman?

Salespeople generally earn 20% to 30% of the dealership’s gross profit from the sale. This means the actual dollar amount depends on how much profit the dealership makes on each transaction—often higher on used cars and add-ons.

What percentage of a car sale is profit?

Typical dealership profit margins range from 2% to 5% on new cars and 10% to 20% (or more) on used cars, depending on reconditioning costs, market demand, incentives, and negotiation. Because commission is tied to profit, used cars often yield higher earnings for reps.