On this page

In the densely crowded FMCG (Fast-Moving Consumer Goods) industry, characterized by high product turnover and short purchase cycles, where customers frequently switch labels and patron retention is crucial to survival, loyalty programs can deliver unique advantages for a business. A purpose-structured FMCG loyalty program keeps customers continuously engaged, generating consistent sales and ensuring buyers don’t stray to a rival banner.

An FMCG loyalty program also ensures the business for the next future by fostering long-term brand affinity. Returning customers shell out 67% more money than new ones, meaning the brand has gained a high-value asset, quite possibly, for life.

From predictable revenue to sticky customer experiences, a strategic loyalty program can move key needles for FMCG and consumer goods brands in the United States. It ensures they consistently stay top of mind in a crowded and competitive market.

In this comprehensive guide cum playbook, we cover:

- Overview of customer loyalty in an FMCG context

- Customer retention challenges for FMCG and consumer goods brands in the modern day

- How well planned, digital-first loyalty strategies can deliver breakthroughs for FMCG brands other tactics and approaches cannot

- Ways to implement an FMCG loyalty program for your retail or consumer goods brand

- Examples of best FMCG loyalty programs from the industry

Understanding the FMCG space

Poised to reach USD 18.96 trillion by 2032, the FMCG sector is one of the largest and most dynamic components of the global economy, accounting for nearly 50% of total retail sales worldwide. An important part of our daily lives, FMCG also encompasses CPG, or Consumer Packaged Goods.

Examples of FMCG and CPG are non-durable items customers use daily and replenish quickly – such as food and beverage, groceries and stationery, on-the-go snacks and condiments, cosmetics and items of personal care, household essentials (including hygiene, toiletries and cleaning products), office supplies, over the counter pharmaceuticals, (some) items of clothing and fashion accessories, and others.

The FMCG space teems with iconic brands – Coca Cola, Nestle, L’Oreal, Mondelez, Johnson & Johnson, Pepsico, Unilever, and Procter & Gamble, to mention some – that are part of pop culture and lifestyle, and household names in more ways than one.

Key characteristics of the FMCG and CPG sectors:

- High purchase frequency and sales volume

- Relatively low profit margins per unit

- Quick consumption and short shelf life

- Heavy reliance on supply chain and distribution channels

- Driven by trends, innovation, tech adoption, and consumer engagement

- Dominated by branding and advertising

- Focus on affordability and convenience

- Fierce competition

Loyalty in FMCG and CPG: Where do the opportunities lie?

High competition, price sensitivity, shifting trends, fickle consumers, and the pressure to escape the commodity (‘me-too’) trap mean FMCG and CPG brands have to constantly push themselves to stay visible, relevant, and desirable with buyer demographics.

Building emotional bridges with users, using technology to create clutter-breaking interactions, and getting innovative with the value one brings to the table – all neatly bundled into a lucrative loyalty program - offers a powerful and lasting workaround to these challenges.

Done well, an FMCG loyalty program can effectively make the competition irrelevant and create a blue ocean for FMCG and CPG companies.

FMCG loyalty programs also make eminent commercial sense. According to Accenture, 57% of consumers spend more on brands with which they are loyal. A Bain & Company study claims that a mere 5% lift in customer retention can generate at least a 25% increase in profit.

Not surprisingly, over 90% of companies in the United States practise some form of loyalty program or engagement exercise.

What is an FMCG loyalty program?

FMCG and CPG loyalty programs are dedicated customer retention strategies developed specifically for these sectors to ensure repeat purchase by devoted customers who consistently – sometimes even irrationally - choose the brand over competitors. The goal of FMCG loyalty programs is to provide long-term growth and brand familiarity in competitive markets.

In a KPMG survey, as many as 75% of consumers favored brands with a loyalty program, or would switch to a rival that had a better one!

Why do people join loyalty programs anyway?

Spending money is a hedonistic pleasure that people love being congratulated for. The dopamine hit is multiplied manifold by the knowledge that other people are not getting the same privileges and goodness.

A loyalty program fulfils the contradictory dual duty of both stimulating indulgence, and lightening the accompanying sense of guilt by delivering value in return.

Why should an FMCG business have a loyalty program?

- Stephen Zagor, a Columbia business professor and restaurant industry consultant.

Research has shown that 70% of emotionally engaged consumers spend up to twice or more on brands they are loyal to (source). Amazon Prime subscribers, for instance, are known to spend nearly twice as much as non-subscribers, according to Consumer Intelligence Research Partners.

The good news for FMCG loyalty leaders?

Despite being bombarded with loyalty programs left and right, customers remain open and optimistic to new options. In fact, they would even be ok to pay for a new loyalty membership if they felt the value was correct.

74% of respondents surveyed in the US, and about half of global customers, are also willing to share personal information, despite rising concerns over data privacy, if that means receiving a better experience from brands.

Penty to play for

An expertly crafted loyalty program can drive an avalanche of benefits for FMCG brands, like:

- Circumventing intermediaries and middlemen to establish direct relationship bonds with payers and patrons.

- Capturing vital customer data to inform smarter decisions around rewards, personalization, and customer experiences.

- Building predictable sales and driving recurring revenue that isn’t dependent on pricing, competition, seasonal peculiarities, market disruptions, or economic uncertainties.

- Opening up additional revenue opportunities via upselling and cross-selling.

- Expanding customer base organically and cost-intelligently via positive reputation, reviews, and referrals.

- Influencing metrics that matter like reducing churn and customer acquisition cost (CAC). increasing purchase frequency and average order value (AOV), and lifting annual recurring revenue (ARR) and customer lifetime value (CLV).

- Gaining the ‘super power’ to stop competing on price alone – letting emotional connect and goodwill do a substantial part of the heavy lifting.

- Staying resilient in times of rising costs and tight budgets.

- Building a compounded brand ethos, ecosystem, and equity - comprising community, partners, and advocates - that’s larger than the linear sum of the individual parts.

Brands are also using loyalty programs to claw back from a lean phase. J.C.Penney, which filed for bankruptcy in 2020, has a new rewards program that doubles the speed of points generation for members (not unlike Kohl’s Cash) while Target, smarting from a sales slump, updated its free loyalty program that automatically applies deals and offers subscription like benefits (such as free shipping) like Amazon Prime and Walmart.

Here’s a fun peek at some loyalty programs from recent years that have been crushing it. The list – featuring FMCG and non-FMCG brands – is rustled up by Newsweek and Statista every year.

Loyalty in FMCG and CPG industries: Challenges

Staying emotionally meaningful and relevant for the customer consistently over long periods of time can be difficult, no matter what the industry, but FMCG and CPG businesses have it tougher than other sectors. After all, customer retention rate in the consumer services and retail sector hovers between 63% and 67%, amongst the lowest across industries.

For those who successfully crack the code, however, the spoils are high: Data analysis firm Statista predicts the global loyalty management ecosystem to touch $24 billion by the end of 2029.

The trick is to muster the vision and resourcefulness to rise above the challenges that typify the FMCG space. Let’s take a look at what they are.

1. The data gap

FMCG and CPG items are mostly sold on a mass distribution model through retailer outlets, supermarkets, and third-party e-commerce sites. While the vast geographical reach and value networks of the latter open up massive opportunities for FMCG brands, these ‘gatekeepers’ also rob the parent company of one-on-one engagement opportunities with the end user.

Making matters worse, the physical outlets and digital platforms own customer data, and not the parent brand.

Without ‘zero party’ (self-owned) data, the business has no way to confirm the precise identity, behavior, or feedback of their most important asset - customers.

They can’t know, for instance, who’s spending more, or on what. ‘Phantom users’ - folks without a face or activity history – are practically useless for a brand (even if they number in millions) when it comes to designing vital FMCG loyalty assets and mechanisms like unified customer profiles, omnichannel experience,s and differentiated offers in price-sensitive markets.

2. Fickle customers

FMCG customers are spoilt for choice, empowered with digital discovery tools, constantly bombarded with trends, and used to being pampered. They not only demand more from their favorite brands, but evaluate value in broader ways than in the past.

On their wish cum check list are aspects like quality, pricing, service, simplicity, privacy, personalization, communication, and post-purchase support. Exposed to the best of practices globally, modern FMCG customers know exactly what’s possible - and are far more willing than earlier to ghost companies who don’t keep up.

The result?

Even the slightest dissonance between expectation and experience can cause customers to switch camps. The ‘low stakes’ and interchangeable nature of the items doesn’t help the cause of loyalty either: FMCG and CPG items are not life savers or without alternatives.

Finally (and perplexingly, given the ubiquitous nature of communication channels these days), people are sharing less and less feedback, both the good and the bad kind, leaving brands little to work with (source).

Not surprisingly, then, the customer churn rate in CPG hovers around 40% - one of the highest amongst all sectors – making it hard for brands to build meaningful, long-term partnerships.

3. Stiff competition

The FMCG and CPG supermarket shelf space is fiercely contested. Apart from traditional factors like low barriers to entry,a high number of players in nearly every category, and a vast retail landscape (spanning wholesalers, distributors, and retailers), new trends and disruptions exert additional pressure on the business.

4. Private labels

Also referred to as ‘store brands’ or ‘own brands’, private labels are rivalling big names and gaining significant traction as well. Private labels leverage the advantage of direct exposure and interaction with customers to gain behavioral insights, optimizing product and pricing to drive the dual holy grails of customer satisfaction and business profit.

5. DTC or direct to customer trends

FMCG by definition sells en masse at scale; a cookie-cutter approach that leaves a gaping opportunity gap for individualization and personalization. Born-digital companies are now filling it fast.

DTC brands bypass the brick and mortar model to engage customers through direct, authentic, and meaningful connections built upon instrumented business models that are data-rich and asset-light.

Some guys doing it to great effect are Warby Parker, Dollar Shave Club, and the iconic YouTuber Mr. Beast owned Feastables (source).

6. Q commerce

Or quick commerce, is upsetting classic FMCG and CPG distribution models and networks by guaranteeing faster delivery times.

7. Trust and authenticity

41% of shoppers patronize only brands they know and trust. In an always-on social era, building and maintaining trust is both important and challenging for FMCG companies.

It takes just one viral video of poor hygiene practices on the factory floor, or a single boardroom decision that unwittingly portrays the company’s values in poor taste, for the trust of fans and communities to crumple.

Johnson & Johnson's baby powder was found to contain asbestos, resulting in significant legal repercussions for the company. Kellogg's faced allegations of sourcing palm oil from suppliers linked to deforestation, a blow to the brand’s claims of being a sustainability-first company.

Cadbury’s – a Mondelēz brand – faced considerable public backlash in India when worms were discovered inside its candy bar, an incident that may well give its PR teams sleepless nights.

A positive reputation built around the pillars of ethics and responsibility is central for FMCG companies for:

- Ensuring that fans keep returning

- Avoiding PR and financial debacles

- Meeting industry regulations

- Nurturing investor confidence

- Building strategic partnerships

8. Digital transformation

New advances in technology and AI tools are finally enabling FMCG and CPG companies to create the kind of compelling digital experiences their markets truly love, unlocking massive, previously unexplored opportunities in the process.

However, this also means that FMCG and CPG businesses need to build complex capabilities across functions like data analytics, cyber security, and digital supply chain management, to name a few of the many moving parts.

The overarching ask - a holistic, organization-wide commitment towards digital transformation, and a ground-up overhaul of strategy and mindset – is not something all businesses will find easy to carry out or sustain.

How to build an FMCG and consumer goods loyalty program?

Nearly every brand worth its salt has a loyalty program these days, or is planning to launch one. The average American consumer is enrolled in about 18 loyalty programs. That’s a lot of app notifications and drip campaigns to keep up with. Not surprisingly, they’re actively utilizing only about 50% of them (source). Fatigue is setting in.

For FMCG brands, therefore, it is not enough to merely have a loyalty program. The program must also stand out by capturing members’ imagination, earn their trust, and delivering exceptional value.

According to a Deloitte retail industry report, strengthening loyalty programs is the top priority for surveyed executives.

Standing out in a heavily crowded market by giving fans what they want, while keeping the profit registers ringing and also generating brand love (aka emotional loyalty), is a balancing act FMCG and consumer goods businesses must master.

What do customers want?

It helps to start here. A Deloitte survey across the US, UK, India, and Brazil reveals that consumers rate financial rewards and simplicity as the top attributes of a loyalty program.

Deals are what more than half of the surveyed consumers across markets look for in every purchase. They also want flexible and digital-centric programs. A key expectation is personalized and differentiated experiences that step beyond simply money.

Among other demands are pricing and value, customer service, convenience (such as consolidated omnichannel experiences and buy-now-pay-later type payments), social commerce integration, and sustainable shopping.

A high-performance FMCG and consumer goods loyalty program must be mindful of these developments and tactfully integrate as many as possible into its fabric.

Here are some best practices and thumb rules for starting – or improving – a loyalty program in the FMCG or CPG space.

1. Build a unified, coherent, and consistent value proposition

Companies need to bring the three significant drivers - loyalty, pricing and promotions - on a standard platform, helping each grow stronger by feeding off the other two.

This also involves removing silos between product and marketing, and synchronizing the departments in real-time. An actionable template can look like this:

Stage 1: Reach

Lead by pricing to reach more customers. Create an attractive value proposition for price-sensitive markets to expand the brand’s loyalty base first. Amazon played the pricing game masterfully by offering Prime Memberships for a very low price.

They did it again by launching the now-iconic annual Prime Day, which features heavily marked-down price tags across categories.

Stage 2: Behavior

Led by loyalty to rewire customer habits. For example, use points that encourage consistent purchase instead of discounts that only influence short-term, need-based transactions.

Stage 3: Combine

Combine 1 and 2 to deliver relevant, meaningful, and personalized experiences that flywheel a customer retention initiative for the business that scores on all leading loyalty KPIs.

2. Establish the tech backbone and process framework

63% of customers are willing to share their data for a better customer experience, and more and more FMCG loyalty programs are turning to technology to deliver the goods, so to speak.

Cutting-edge digital mechanisms and tools can transform key FMCG loyalty metrics like GTM or Go-To-Market (via agile, real-time decision making), pricing (via cost rewiring), and brand affinity (by building memorable touchpoint experiences).

For brands starting, here’s the drill:

- Prepare to reboot tech capabilities and create room for tech investments.

- Audit legacy systems, weeding out what has outlived its utility.

- Prepare the groundwork for an advanced Loyalty Analytics framework that blends AI, consumer-backed insights, and behavioral data sources.

- Data lies at the core of any analytics exercise; construct agile methodologies for data curation, data cleaning, and data management.

- o With complex habits and behaviors driven by a variety of sentiments and trends, consumer sentiment no longer aligns neatly with consumer spending.

FMCG loyalty teams need to explore every source of data available at their disposal to be able to pick the customer’s mind, relentlessly and in real time.

Here's what they can do to build a granular, 360-degree vision of the customer that ensures informed strategy choices.

- Trawl online interactions, website transactions, purchase, and invoice documents

- Conduct surveys and polls

- Scan CRMs, CM,S and internal databases

- Study conversations in social media and online groups

- Invest in emerging capabilities like social listening tools

- Approach data brokers

- Connect with third-party sources

A Gartner report reveals over 70% of advertisers believe retail media networks can be instrumental in driving engagement and sales.

Tech can help FMCG loyalty programs bypass ecosystem channels and reach customers directly.

Case in point: When Reckitt Benckiser owned Schiff, it launched Schiff Rewards, which rewarded members for entering product codes regardless of the retailer or store from which they bought it.

This effectively made Schiff’s data sourcing strategy channel-agnostic, allowing the company to establish a direct connection with users. The company utilized this leverage to amplify its emotional connection with users through various FMCG loyalty activities.

Plug Artificial Intelligence at strategic layers to augment and amplify key Asks and mechanisms. AI can create predictive models that parse historical data, such as customer preferences and purchase history, to guide informed decisions, hyper-personalize key journey milestones, and encourage greater spending.

Procter & Gamble and Nestle use AI to drive product innovation. Unilever leverages AI to optimize its supply chain. AI is personalizing Coca-Cola’s marketing and Kraft Heinz’s recipes, while helping Pepsico forecast demand. L’Oreal is exploring the next frontier of beauty tech with the help of AI, while Danone is using it in a sustainability context. Both Johnson & Johnson and Mondelez International tap into AI for loyalty analytics and customer insights

Each of these interventions moves a key needle in FMCG loyalty, whether it be quality, convenience, or personalization.

Blending the product and the loyalty experience delivers better results. For example, brands can ensure that their loyalty program activates by default (at a minimal cost or for free) the moment a customer starts a product subscription. This ensures that customers are exposed to the loyalty program more frequently and end up using it more often.

Get innovative with the loyalty sign-up mechanism. Choose a format that captures customers in their current channels (without the need to switch platforms), and make onboarding attractive, simple, and quick.

Some common ways to sign-up members for FMCG loyalty programs are uploading purchase receipts, scanning QR codes into the app or website, providing a code at POS (Point of Sale) or when ordering through the app, mass coupon code campaigns, distribution at special events and public places, and others.

- Set customer-facing KPIs and mechanisms. Do this in collaboration with cross-functional teams to enhance the integration of real-world data and increase trust in the system.

- Design loyalty team systems and processes to enable and encourage collaborative workflows. This structures streamlines and democratizes access to key information like insights, feedback and reports, enabling better efforts and outcomes.

- Sync FMCG loyalty frameworks with native business tech and systems like CRM and CMS to create an unbroken and consistent ‘knowledge network’ that elevates loyalty program decisions and actions.

- Digitally native customers spend their time on an entire clutch of platforms, not just one. To catch them in their favourite haunts, an FMCG or consumer goods loyalty strategy must adopt an approach that is ‘Always On’ and Omnichannel in both principle and practice.

Ikea Family, the legendary Swedish furniture brand’s flagship loyalty program, brings in-store and online worlds together purposefully. Amongst various benefits, members can add their IKEA Family Card to their mobile wallet and access benefits while shopping online.

GAP Good Rewards, GAP’s loyalty program, stores all of a member’s points in one consolidated destination for convenient tracking and redemption on the go, irrespective of whether members are using their card or mobile.

- With M-commerce accounting for nearly 60% of total retail e-commerce sales, mobile optimization is table stakes for modern FMCG and consumer goods loyalty programs.

- Leveraging experiential technologies such as augmented reality (AR) or virtual reality (VR) enhances product understanding and boosts purchase confidence in users, while providing a memorable visual experience. Covergirl allows users to try on shades and colors virtually within the browser using a live camera, eliminating the need for an app download.

- Ensure tech, trade, and legal compliance.

- Prioritize privacy safeguards and security infrastructure with multi-factor authentication, strong encryption, access controls, and consent management.

- Make sure loyalty engines are designed ‘API first’ for seamless interoperability and integration across native systems, e-commerce sites, POS systems, mobile, and others.

- Build no-code or low-code workflows that enable loyalty team members without technical backgrounds to operate with ease.

- Have a documented governance structure in place.

- Easy pay mechanisms are core to building great customer and loyalty experiences today. Customers look for speed, flexibility, portability, and security when it comes to payments: built-in convenient pay options and integrations such as digital wallets, mobile payments, and buy-now-pay-later options.

- Distil the complex matrix of pricing, promotion, and loyalty into a simple, seamless, and consistent experience for customers across digital and physical dimensions - delivering the correct personalization at the right touchpoint at the right time.

- Launch the FMCG loyalty campaign, communicating rules and benefits clearly to customers, merchants, internal teams, PR media and other stakeholders. Create a dedicated loyalty program page with a comprehensive FAQ section that compactly and transparently conveys program highlights to spur opt-in rates.

- You’ve put in the effort - now promote your loyalty program aggressively. Optimize for search visibility (SEO), incentivize brand advocates and influencers to talk about it, run social media campaigns, and promote on checkout, product pages, emails, newsletter, and mass media.

- Automate, monitor, measure, seek feedback, refine, and repeat.

3. Choose the right model for your FMCG loyalty program

FMCG or consumer goods loyalty programs come in many shapes and avatars, and clubbing of loyalty formats isn’t uncommon. A growing number of organizations (like Target, to name one) offer a paid subscription alongside their free-to-join loyalty program to offer more choice and lure members towards a VIP style model.

Opt for a pure-play or hybrid model that makes the most sense for your business.

Here are some popular models from the FMCG/CPG loyalty terrain.

Points-based loyalty

Arguably, the most common type of FMCG loyalty format is modelled on linear points accumulation based on the member’s spending pattern. Points are redeemed for free products and various benefits.

Global food and beverage leader PepsiCo’s Tasty Rewards is a points-based FMCG loyalty program that offers points for purchasing the company’s products and participating in contest-like, gamified activities. Points can be redeemed for money-saving offers, giveaways, and sweepstakes entries.

Family Rewards by Kellogg's, the well-known cereal brand, is another points-driven Earn-and-Burn type FMCG loyalty program that allows customers to redeem tokens (points) for gift cards, branded merchandise, limited-edition snacks, and other goods and goodies. The program also adds a touch of personalization by giving members free bonus tokens on their birthday.

Starbucks Rewards, from the global coffee leader, is a points-based FMCG loyalty program where members earn Stars for every dollar spent; Stars can be redeemed for free coffee, merchandise, and other rewards. The program is integrated across web, mobile (Starbucks app,) and in-store, allowing customers to order, pay and collect/redeem points wherever and whenever they want

Tier-based loyalty

Tiered loyalty programs in FMCG lay out the red carpet for a highly personalized, VIP-vibed shopping experience. This is a model where members can join Silver, Gold, and Platinum type levels – progressively climbing up the ranks as they spend on the brand. Each tier comes with unique benefits and privileges. A tiered FMCG loyalty model works particularly well for customers who appreciate exclusivity and VIP treatment.

French personal and beauty care icon Sephora’s Beauty Insider is an industry-leading FMCG loyalty program with a hybrid format: Its points-based structure leads into a loyalty model that features tiers called Insider, VIB (Very Important Beauty Insider), and Rouge.

Each level offers more rewards based on annual spending, with benefits that include exclusive access, complimentary products, and other delights highly sought after by fans. The Route level offers a lavish 20% discount during Sephora’s annual sales.

MyMcDonald’s Rewards, the global fast food giant’s massively popular loyalty initiative, is a tiered FMCG loyalty program that’s seamlessly integrated with McDonald's delivery app, allowing users to order food and track and redeem points from the same digital destination.

The program is aimed at lifting McDonald’s overall customer experience and brand vibe with innovations like digital ordering kiosks, digital menu boards, flexible payment options, and more.

Adidas’s tiered loyalty program provides opportunities to win free VIP (box seat) tickets to top concerts and sports events.

The Nordy Club, the status (tier) based loyalty program of online luxury, fashion, and beauty retailer Nordstrom, goes the non-monetary route with value-added experiences like style workshops, access to invite-only style events, and in-home stylist visits.

In the luxury retail space - think Macy’s, Neiman Marcus, and Bloomingdale’s, where the top tier has a minimum spend of $600,000, or high-end online retailers like SSENSE and Farfetch - higher tiers can translate into ritzy experiences like swanky gifts, private trips, personal stylists, and shopping concierge services.

Gamification-based loyalty

Gamification uses game emotions and elements like contests, challenges, leagues, trophies, progress bars, and leaderboards to keep members engaged and (re) visiting. This format embeds sophisticated gamification dynamics within a native loyalty structure, turning rewards accrual into a natural and addictive program extension.

Like in tier-based models, members can advance through stages by completing fun tasks and interesting missions. Gamification can be personalized based on the member’s gaming behavior and also integrated with social ecosystems to build a sense of community, encourage sharing, and deepen involvement.

US fast-casual dining trailblazer Chipotle is an acknowledged master of the loyalty game, so to speak. The company has launched ‘Summer Of Extras’, a fun gamified experience where opt-in loyalty members can earn extra points and sweepstakes entries for completing a fixed number of milestones per month.

KFC Rewards Arcade – a highly popular FMCG loyalty program from fast food frontrunner KFC, which runs exclusively on the company’s app – displays an impressive collection of arcade-style games and mini-games on its loyalty page.

Members play to win ‘fingerlicking freebies’. The hugely successful idea led to a 53% increase in app downloads, with 70% of customers saying they would recommend KFC Rewards Arcade to friends and family.

Xbox Live's loyalty program, integrated into Microsoft Rewards, leverages gamification strategies such as challenges and achievements to enhance member engagement and loyalty.

Subscription-based loyalty

In this model, members pay an upfront, regular fee to access assured benefits over a specified period.

Many will describe Amazon’s Prime membership as the definitive example of a subscription-based FMCG loyalty program; it offers free shipping, free streaming, and exclusive deals to keep members spending more (on Amazon’s website) than non-members.

Walmart+ , retail stalwart Walmart’s loyalty extension, is a similar subscription-based FMCG loyalty program that offers a host of benefits to make shopping more affordable and rewarding, such as free shipping, free content, special gas prices, convenient delivery services, and more.

British sandwich and coffee chain Pret A Manger offers a coffee subscription with unlimited drinks for a monthly fee.

Values-based loyalty

There are no explicit rewards or discounts in this FMCG loyalty model. Instead, the brand commits to donating a portion of its proceeds to charities and causes that it supports, and that loyalty members care about.

Consumer goods giant P&G’s Good Everyday program, which inspires members to be a ‘Force For Good,’ is a fine example of an FMCG loyalty program driven by values and purpose.

It makes members feel good by allowing them to make a real difference through the company’s diverse contributions in areas such as equality and inclusion, community impact, and environmental sustainability. P&G donates to its charity partners each time someone earns points by making a purchase.

Coalition or partnership-based loyalty

Partnership-based FMCG loyalty programs – also called coalition loyalty programs - can be a win-win; they allow each participating brand to expand its customer base while sharing tech capabilities, marketing networks and operating costs.

CAVEAT: Coalition loyalty may give rise to challenges such as the interoperability of tech systems, concerns about data privacy, and alignment of brand philosophies.

Canadian-based community pharmacy Pharmasave tried it to solid effect by joining the Canada-based Air Miles Reward Program; Air Miles is a coalition loyalty program with over 10 million active member accounts. The coalition increased Pharmasave’s sales and attracted new customer demographics to their local pharmacy outlets.

Walmart tie-up with Burger King is a case study in FMCG loyalty partnership. It allows members of Walmart+ - Walmart’s loyalty platform - 25% off on Burger King items (along with a free flame-grilled Whopper!) when they order through Burger King’s website or app.

The Blackbird app, launched recently in select cities in the US, allows users to earn loyalty points by dining at participating restaurants. It also offers flexible payment options via wallets, cards, or $FLY, Blackbirds' equivalent of cash.

Kitchenware and houseware company Williams-Sonoma operates The Key Rewards. This unified loyalty program operates across the firm’s ‘multiverse of brands’ featuring West Elm, Pottery Barn, and Mark and Graham. A single, omnichannel app connects them all seamlessly, allowing members to toggle across brands frictionlessly as they earn and redeem points.

While not strictly a coalition model loyalty program, Williams-Sonoma demonstrates how expanding the brand and rewards repertoire through multiple partnering companies can be a significant selling point for an FMCG loyalty program.

Referral-based loyalty

A format that’s arguably the most actual embodiment of loyalty, where satisfied customers voluntarily advocate for the brand, with rewards only adding flame to the fire to keep consistency levels up. Happy users (‘believers’) use their credibility and influence to drive sales by sharing recommendations and reviews about products and services they have personally tried and liked.

American cosmetics brand Elf Cosmetics offers a referral-based loyalty program that allows members to earn 175 points (worth $5) for every friend who uses their share code on their first purchase of $25 or more. This is a two-sided referral program where both the referrer (the friend) and the recipient enjoy $5 off when they purchase items using the code.

US-based water treatment company Culligan Water runs a double-sided referral loyalty program. Referrers earn a $100 gift card towards a brand of their choice, while anyone they refer receives $100 off on their new Culligan water treatment system.

NY-based cosmetics brand Julep lets members invite friends and get a $15 credit for every bestie who joins.

Cashback-based loyalty

Dell Rewards – the rewards program of Texas-based technology multinational Dell - operates on a straightforward cashback system. Members can join for free and earn up to 9% back in rewards to use toward future Dell purchases. They also enjoy benefits like free expedited delivery.

4. Go green

Increasingly, consumers are letting their values guide their purchasing decisions. A study by NielsenIQ found that a sustainable lifestyle matters to 78% of US consumers. A PwC study shows consumers are willing to pay a 9.7% premium for sustainably produced or sourced products.

Gen Z and Millennial customers are 27% more likely to purchase from a brand that cares about its impact on people and the planet. And 89% of customers say they are more likely to be loyal to a brand that shares their values.

A FMCG or CPG loyalty program should therefore carry a green component. It can reward members for environmentally responsible behaviour, donate to green charities, support communities that advocate against climate change, adopt practices that are kind towards the planet (digital cards instead of plastic ones, for example), and ensure that incentives and rewards are eco-friendly.

Madewell partners with Cotton’s Blue Jeans Go Green denim recycling program, through which customers can donate old jeans to be repurposed as insulation for housing. In return, they get $20 off a new pair.

Skincare brand Kiehl’s rewards its customers for recycling their empty bottles and containers with points or currency-like stamps. The website clearly articulates the company’s principles - respecting natural resources, empowering global communities, and supporting the circular economy.

5. Hyper personalize

Amazon founder Jeff Bezos once said, "If we want to have 20 million customers, then we want to have 20 million stores”, underlining the criticality of one-on-one individualization in FMCG and retail.

3 in 4 consumers are more likely to patronize a brand that offers ‘just for me’ experiences. US beauty retailer Ulta’s loyalty program, Ulta Beauty Rewards, for instance, allows members to select their birthday gift.

Personalization begins with high-quality data on user history and habits, which helps establish a “persistent customer persona” and a single source of truth for FMCG loyalty teams to inform hyper-tailored customer experience (CX) strategies.

- Mobile apps are the top playground for personalization, with 57% customers preferring personalized support through apps over web chats or call centers.

- Content amplifies personalization tactics, with two thirds of consumers leaning towards content that demonstrates an understanding and anticipation of their needs.

- AI takes personalization to the next level with adaptive learning based on real-time feedback, advanced data science and predictive modelling that creates contextual recommendations and drives mood-aligned decisions.

Amazon’s Alexa personalizes responses by voice. Starbucks suggests flavors and offers based on tracking past consumption patterns. Spotify shares discovery playlists based on listening habits and favorite artists.

Netflix sends content recommendations after parsing the viewing, search, and rating history of its subscribing members. Sephora achieves exceptional email open rates with personalized product recommendations based on members’ browsing and purchase history.

6. Innovate beyond transactions

The best FMCG loyalty programs are much more than point collection rituals. Their real value lies in taking the brand connect to the next level in a way that the core product or service dynamic cannot.

Out-of-the-box experiences and non-monetary rewards are a great way to do that. They address deeper (intrinsic) motivations of customers, trigger meaningful relationships, and generate the holy grail of all loyalty – passionate brand advocates.

At a practical level, they provide opportunities to keep members intrigued and engaged throughout the year, not just during checkout.

For best results, FMCG brands need to strike a balance between monetary and non-monetary incentives.

Here are some themes to tinker with.

- Incentivizing tasks. This includes profile completion, app downloads and following and sharing the brand on social media.

- Action and fun. Have more activities, games, and challenges. On IKEA Family, IKEA’s loyalty program, members can earn points for various actions, such as building a wishlist, creating kitchen or sofa designs on the planning tool (available on app or web), or simply logging into their IKEA Family account. On Lays’ Do Us a Flavour campaign, customers can submit their own Lays’ flavour ideas and get an opportunity to see their suggestions come to life.

- Touching, emotion-first gestures. PetSmart Treats capitalizes on the emotional connection members have with their pets through services like pet grooming and training, special birthday perks, donations to PetSmart charities, fun tier names (like Bestie and Very Important Pet Parent), and quirky offers, such as removing a tattoo members dislike with a free tattoo of their pet.

- Self-improvement and self-enhancement avenues. Nike Membership is an FMCG retail loyalty program that enables users to access expert advice on sports and style, as well as personalized workouts and training plans.

- Brag-worthy moments. Adidas’s tiered loyalty program arranges exceptional meet-and-greet opportunities with athletes. Fair to assume that starstruck fans go on social share overdrive with their pics soon afterward.

- Lifestyle enhancers. Luxury retailer LuisaViaRoma’s LVR Privilege program combines points with perks, including yoga classes and wine tastings.

- Building online tribes. Fans find like-minded groups to share a vibe, load up on inspiration, and seek advice from other members, similar to Nike Membership.

- Giving back. Members can volunteer or contribute to community development via outreach programs.

- Above and beyond. Scandic Hotels offers lifestyle-centric communities that feel like ‘family’ to members.

FMCG loyalty - Simplified by Loyalife

Xoxoday Loyalife is the world’s leading software used by Fortune 500 giants, family-run retail businesses, and startups to kick-start, manage, and optimize high-performance FMCG loyalty program value chains, end-to-end, from a single platform.

Loyalife helps you build a unified FMCG loyalty experience across touchpoints, personas, and retail categories.

Works for every loyalty type and model

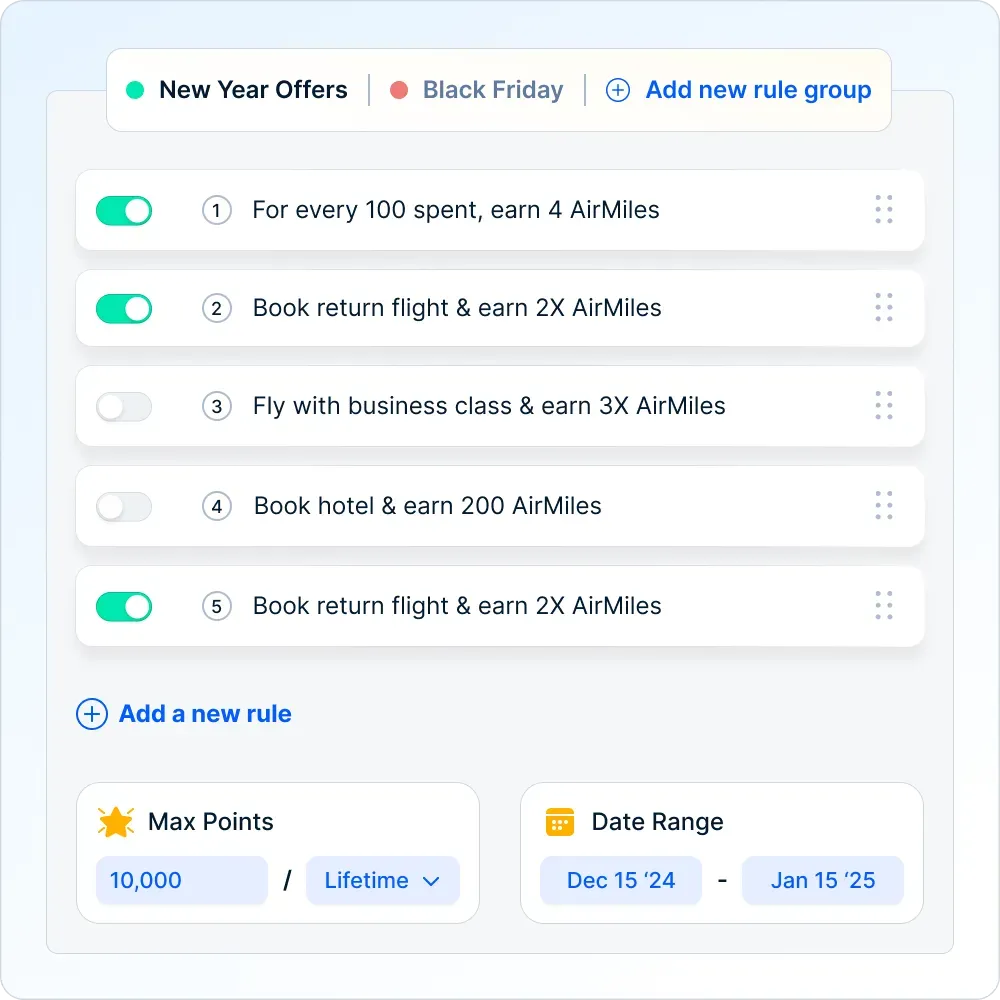

Built for enterprise flexibility, Xoxoday Loyalife supports diverse loyalty programs across points-based, tiered, subscription, coalition, and every other loyalty format and model. Enable precise earn-and-burn rules, dynamic point values, and tiered incentives to meet the needs of varied customer segments.

Set dynamic rule engines

Dynamically adjust to market trends, customer preferences, and seasonal campaigns by creating custom rules and conditions based on customer behavior and purchase patterns for accruals, redemptions, and tier advancement.

Create sticky and repeated engagement

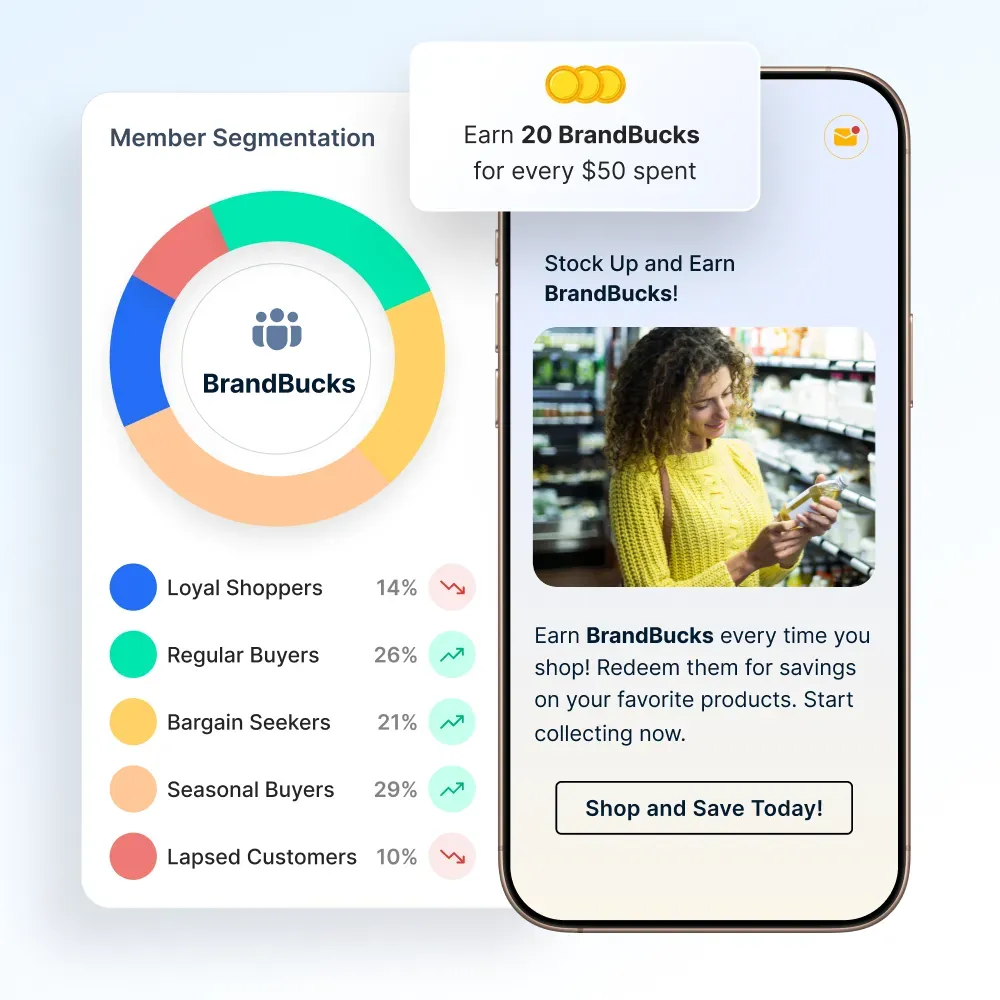

Segment audiences and deliver targeted messages via SMS, email, in-app notifications, and social channels along with tools for gamification, referral programs, and behavior-triggered campaigns.

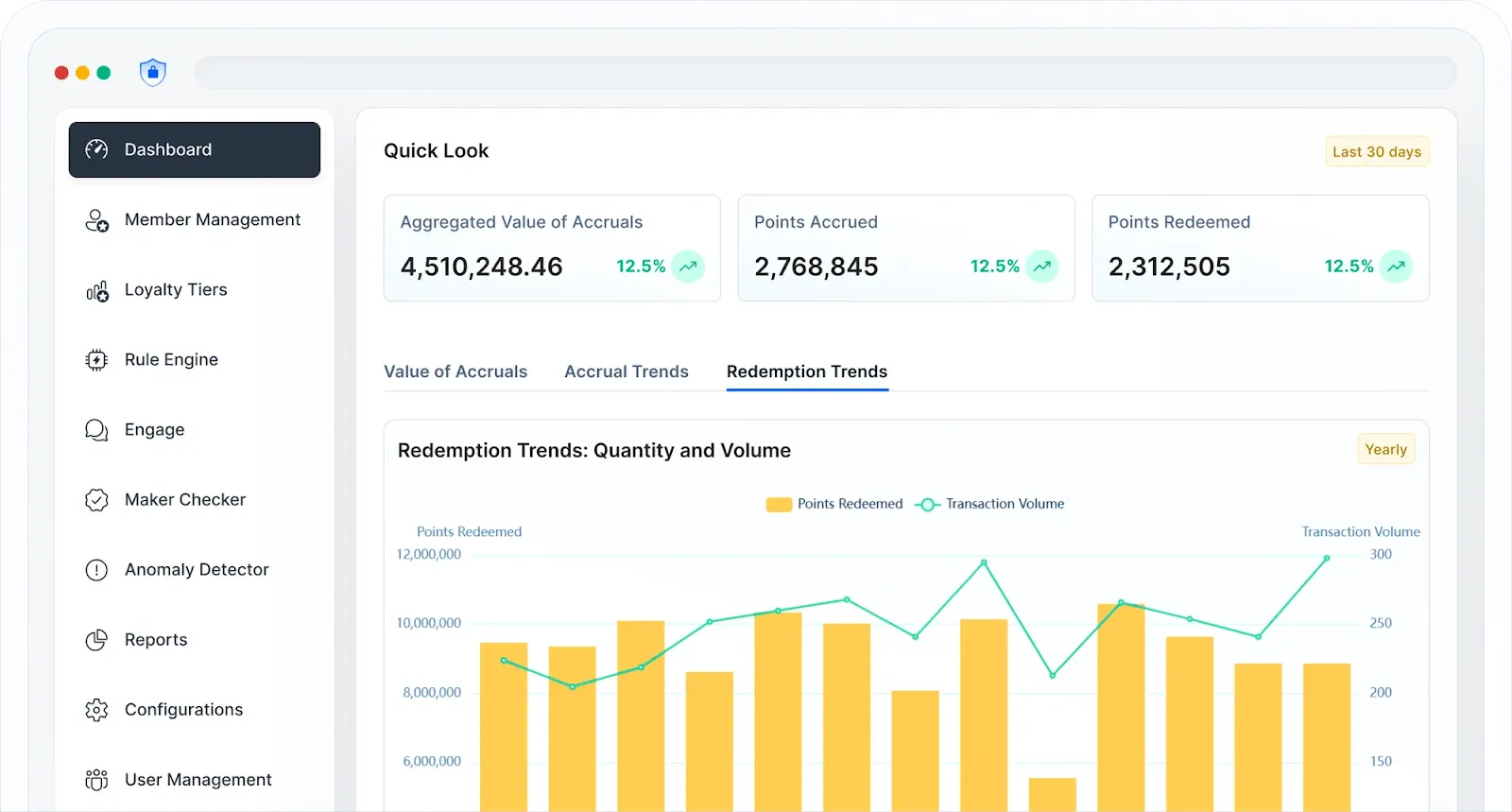

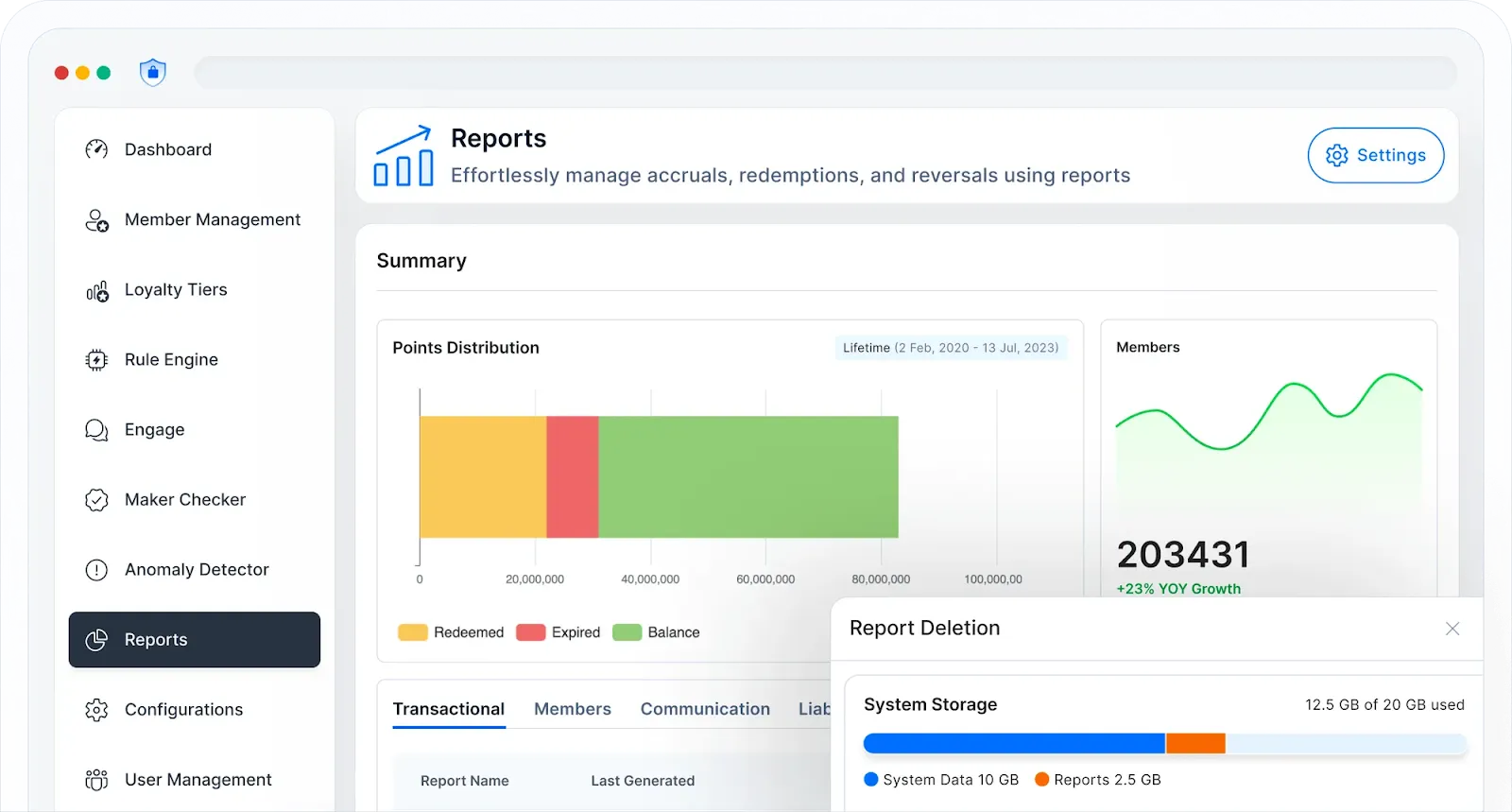

Track moods with a comprehensive Analytics Suite

Gain deep visibility into customer behavior, program performance, and engagement metrics. Leverage AI-driven predictive insights to plan intuitive KPIs across multiple dimensions. Track and crunch transaction history, communication impact, and loyalty trends. Utilize dynamic dashboards and detailed reports to facilitate informed leadership decisions.

Reward memorably with the world’s largest AI-assisted redemption marketplace

Personalize incentives and rewards for every customer persona with 10M+ options across 30+ categories and 150+ countries with Loyalife’s mission-critical FMCG loyalty software.

With seamless API integration, customizable catalogs, multiple currencies, languages, and payment options, opportunities for white-label rewards, and real-time fulfillment backed by enterprise-grade security, Loyalife’s massive marketplace ensures a unique and effortless redemption experience.