Increasing Survey Response Rate With Rewards

Discover what causes low survey response rate and how to overcome it. This blog outlines key challenges, practical solutions, and survey best practices that enhance survey completion rate and help you gather more accurate and actionable insights.

On this page

- What is a survey response rate?

- How is a survey response rate calculated?

- Key reasons why respondents ignore surveys

- 16 Best practices for conducting surveys

- 13 Tips to increase survey response rates

- How rewards and incentives can overcome survey fatigue and boost response rates

- Choosing the right rewards to boost survey response rates

- Crafting your winning reward strategy. Here's a roadmap

- Kantar automates reward distribution with Plum

Have you ever put your best effort into crafting a survey, only to be met with silence? This isn’t just frustrating—it signals a bigger issue: survey fatigue. In today’s world, people are inundated with requests for feedback, leading to disinterest and apathy. The fallout? Incomplete data, inaccurate insights, and poor decisions driven by unrepresentative feedback.

Picture launching a product based on skewed responses, overlooking key pain points, or misinterpreting public sentiment. The cost of ignoring survey fatigue can be significant—damaging your business decisions, customer relationships, and credibility.

In this blog, we’ll explore eight core reasons behind low survey engagement and share actionable solutions to boost completion rates and response quality.

Why do surveys matter? Because they offer a direct line in the minds and motivations of your audience. Whether you're in marketing, HR, or public policy, surveys guide better decisions—shaping products, improving employee engagement, and aligning strategies with real-world needs.

What is a survey response rate?

A survey is likely successful based on the higher response it receives. A response rate is the percentage of people who participated in the survey compared to the percentage of people who viewed it. Not everyone who views or starts a survey completes it. This may be due to various reasons that should be corrected with effective strategies to make it a good response rate.

How is a survey response rate calculated?

The survey response rate is calculated by dividing the number of individuals who completed the survey by the number of individuals who were invited or targeted to take the survey. This result is then multiplied by 100 to express the value as a percentage.

No. of responses received

__________________________________ X 100

Total no. of people to whom the survey was sent

For example, if you had sent the survey to 400 people and the responses received were 120, then the response rate would be (120/400) X 100 = 30%

A good response rate for surveys would be 40 to 50 percent. Organizations should plan the survey so that a good rate is achieved. Otherwise, it does not solve the purpose of the survey.

A good rate is not always achieved because organizations fail to follow certain effective strategies.

Key reasons why respondents ignore surveys

Let's face it, getting survey completion rates can be tough. Understanding why respondents choose to ignore them is crucial for maximizing your chances of engagement.

Here are some reasons respondents hit the "delete" button:

1. Time

In our fast-paced world, every minute counts. If your survey is perceived as too long or time-consuming, respondents will likely prioritize other tasks. Aim for brevity and clear estimated completion time. A study by SurveyMonkey found that surveys exceeding 7-8 minutes saw a 5% to 20% drop in survey completion rates.

2. Effort

Are your questions confusing, repetitive, or require excessive typing? Each hurdle increases the effort required, creating friction and discouraging survey completion. Opt for clear, concise questions with answer options that align with your target audience. ‘User Unfriendly’ surveys have poor UX, making navigating the steps a ‘pain’ also fall in this category.

3. Relevance

If respondents don't see the connection between the survey topic and their interests or experiences, they'll feel indifferent. Even if your topic is aligned with their walk of life, you must make the extra effort to make sure your questions are intelligent, inoffensive, and don’t cross protocols, causes, and compliances. Tailor your survey to specific demographics or behaviors to ensure relevance and capture genuine feedback.

4. Survey fatigue

Imagine walking down a street bombarded by salespeople pitching different surveys. That's what it feels like for many respondents today. We're bombarded with surveys online and offline. Constant participation leads to fatigue and survey apathy. Limit your frequency, vary your approach, and offer compelling incentives to combat fatigue and boost response rates.

5. Transparency

Opaque surveys raise red flags. Be transparent about the purpose of the survey, who's conducting it, and how data will be used. This builds trust and encourages participation.

6. Interest

Are your questions dry and predictable? Inject creativity and intrigue to spark curiosity and motivate respondents to engage. Consider visual elements, interactive formats, or personalized questions.

7. Timing

Sending surveys at inconvenient times is a recipe for disengagement. Consider time zones, cultural norms, and recipient demographics to optimize delivery timing and maximize visibility. Use analytics to figure out online behavior, cultural traits, and work-life patterns to fine-tune your time strategy. Study shows the highest survey completion rate for shorter surveys is observed on Monday (18%).

8. Motivation

Why should respondents invest their time? Clearly communicate the value of their participation and highlight the positive impact their feedback can have. Consider offering incentives or gamifying the experience to further motivate engagement. Among all respondents, ⅓ of them cite earning rewards or prizes as their primary motivation

16 Best practices for conducting surveys

Here are 16 best practices for conducting surveys that you must know to run a successful survey.

1. Make them feel special

Start by telling the respondents that you genuinely appreciate their taking the time and making an effort to participate in your survey. Pad up that thought by adding how valuable their views are for the success of your project.

After careful selection and consideration, if you have chosen them, play up the angle by stressing that they are part of an exclusive and hand-picked group to which this survey is going.

And do express your gratitude - a short message after every three questions can be very effective, followed by a more in-depth one at the end of the survey.

2. Narrow your goals

Narrow your focus to the exact goal/s you are trying to achieve. Limit the critical goals to as few as possible.

This way, not only will you be able to probe deeper into each area (and take up less of your respondent’s time), but you will also end up with more ‘meaningful data’ that is easier to manage.

‘Squeaky Wheel Syndrome’ refers to giving more importance to questions in the front burner or at the top of mind.

However, doing so may make your survey lopsided or skewed. Have a fair balance of questions covering all relevant angles and perspectives so that the results are unbiased and valuable.

3. Watch out for sampling errors

Ensure your ‘Focus Group’ selection is correct and unbiased. If you want to survey kids’ eating habits, don’t shoot your mail to singles. If you want feedback on your new meat grill, don’t share the survey with vegans. You get the idea.

Sub-groups within the population, for example, may ‘tamper’ the findings and make the result ‘ungeneralizable’ since it includes the opinion of people who are not part of your ‘focus group.’

To ensure your questionnaire reaches suitable and relevant people for your study, send it to smaller clusters across different geographies.

The other ‘solution’ is to over-sample to cover as much of the right demographic as possible. However, sampling errors are a stubborn problem in ‘survey country,’ and while you can minimize it, you may not be able to eliminate it.

4. Stay balanced and avoid the squeaky wheel syndrome

‘Squeaky Wheel Syndrome’ refers to the practice of giving more importance to questions that are on the front burner or at the top of mind.

However, doing so may make your survey lopsided or skewed. Have a fair balance of questions covering all relevant angles and perspectives so that the results are unbiased and valuable.

5. Don't get too personal

Don’t get too personal with your questions. Demographic details like age, sex, location, and others will already be there with you, so questions around these will only make your survey sound unprofessional.

Probing into personal and professional details may make your database more granular but may tick the user off. Treating the middle ground with only as much information as you need is best.

6. Keep it simple and logical.

Design your questions in such a way that the respondent:

- Can answer the questions in any order or way - unless there is a good reason behind the sequence you have designed.

- Isn’t rushed to complete the questionnaire within a fixed timeline (or, worse, a ticking clock).

- Isn’t forced to open a dictionary for every 6th word: Ensure the survey isn’t stuffed with fancy words, complicated terms, or industry/trade jargon.

- Has the liberty to skip a question and move on to the next.

- Doesn’t have to ‘find the hidden question in the picture’ you are not designing a game for kids.

- Don’t create compound or layered questions (using triggers like ‘and,’ ‘or,’ ‘not,’ ‘nevertheless,’ ‘however,’ ‘then,’ etc., which effectively packs two or three questions in one). Keep the tone clear, unoffensive, and convincing.

7. Keep it short and sweet

The best surveys are thought-provoking, not time-consuming. They also respect the respondent’s time. Keep visual elements to a minimum to avoid clutter, engage them in a warm and friendly voice, and resist the temptation to cram everything.

See if you can trim down strategy level / long-term questions (save them for another survey) and go for tactical level probes to action over the next six months.

8. Assuming subject familiarity is a bad idea

Don’t assume your respondent has advanced or expert knowledge of the subject. If you are surveying professionals, you still have to factor in reasonable limits of familiarity (remember, if they skip the question, it’s your loss, not theirs).

Provide an easy way for them to access information if they need more clarity on a question. (you can provide sidenotes, footer notes, or Google links)

9. Prompting questions

“We have recently launched a world-class product that boosts productivity, helps save time and cost, and has garnered a 95% rating on Amazon - if you have used it, we would like to know what you think” is a leading question.

A leading question contains built-in information that - without intending to - biases the response. Taking objectivity out of the equation robs you of what could have been a genuine insight.

10. Limit the number of 'open-ended' questions

An open-ended questions focus on collecting qualitative feedback, unlike yes or no questions, which are quantifiable. . They demand a descriptive answer which makes the respondent think and share their feelings and opinions. Open-ended questions are essential to qualitative market research because they provide unique insight and value, something you probably couldn’t have targeted in a yes-no format.

However, having too many open-ended questions can mean ending up with reams of text to decipher (especially if it’s an extensive survey), so limit them to 2 or 3, and plan their theme and wording carefully to cover all the angles you need.

11. User interval questions

Most of us hate being tied down to a commitment. This is because, most of the time, the truth lies somewhere in the grey zone between black and white.

A straightforward Yes-No or Agree-Disagree won’t provide an accurate insight in such cases. Give your respondent broad leeways to play around, such as an Awe-some > Good > Ok > Bad > Terrible or a simple 1 to 5 grading.

12. Keep the rating framework objective (and consistent throughout)

Ratings are potential pitfall zones for two reasons. They may display the ‘letter’ but hide the ‘spirit’ (intent) of the response. For example, a rating of 7 may denote an improvement from 6 or a climb-down from 8, but there’s no way to tell which.

Cracking this isn’t always easy since specific themes that are subjective are, by nature, not conducive to a clinically ‘even’ standardization. Try to remove grey areas and make the question as ‘basic’ as possible.

13. Be wary of duplicate results

If you offer an incentive or reward, people may try to fill up the same survey with multiple items to increase their chances of winning (a lucky draw, for instance).

Address this common syndrome by adding a protocol forbidding anyone from participating more than once.

14. Integrate technology

SaaS companies like Plum, for instance, help you automate the entire process - from configurable & DIY tools to access control across hierarchies to the omnichannel presence (mobiles, for example, make it easy for participants to take the survey at their convenient time and place) to digital reports & actionable analytics.

15. Take advantage of "the follow-up question."

Your survey need not end with your survey. Asking follow-up questions helps you understand why a participant answered a survey in a certain way and unearth valuable insights you may have missed out on ‘the first time around.

This is your opportunity to drill deeper into important angles and aspects, clarify unclear or inconsistent responses (either through details or context), and get more information on viewpoints you found intriguing (and find worth pursuing further).

General, open-ended questions on your product, room(s) for improvement, the recipients’ persona (emotions, events, and visions that influence them) and, in deed, the survey itself: How well, or poorly, they thought it was organized.

16. Stay in touch

Treat your survey as a gateway to a long-lasting relationship rather than a one-off encounter. For instance, keep your word if you have promised them an update or a favor.

If you have told them that their feedback means a lot to you, prove it by sharing details of its impact on your project or business.

Keep them ‘in the loop’ by sharing exciting tidbits on your journey (reminding them that their survey had a hand in shaping it) from time to time - thereby keeping your brand and product top of mind and nurturing bridges for the following survey.

13 Tips to increase survey response rates

Here are 13 effective tips to increase survey response rates with examples from well-known brands:

1. Personalization and targeting

Personalization can significantly enhance survey response rates. Start by customizing your survey invitations to make them more engaging and relevant. Address recipients by their names and acknowledge any previous interactions or purchases they've had with your brand.

Consider segmenting your audience based on demographics, behavior, or other relevant factors. By tailoring your survey content to each group's specific interests or needs, you make respondents feel that their input is valuable, increasing the likelihood of participation.

For example: Netflix's Personalized Recommendations

Netflix is a prime example of how personalization can drive user engagement and survey response rates. They use sophisticated algorithms to analyze user viewing habits and preferences. Based on this data, they provide personalized content recommendations to each user. When Netflix wants to gather user feedback, they send out surveys that are tailored to the individual's viewing history and preferences.

For instance, if a user watches a lot of documentaries, the survey may focus on their opinions about Netflix's documentary selection. This personalized approach increases the likelihood of users responding to the survey because it's directly relevant to their interests.

2. Incentives and rewards

Offering incentives and rewards can be a powerful motivator for survey participation. Tangible rewards like discounts, gift cards, or free products/services in exchange for completing a survey can be particularly effective.

Alternatively, you can create excitement by giving participants the chance to win valuable prizes through a random drawing. Non-monetary rewards, such as exclusive content, early access, or recognition, can also appeal to different motivations and encourage higher response rates.

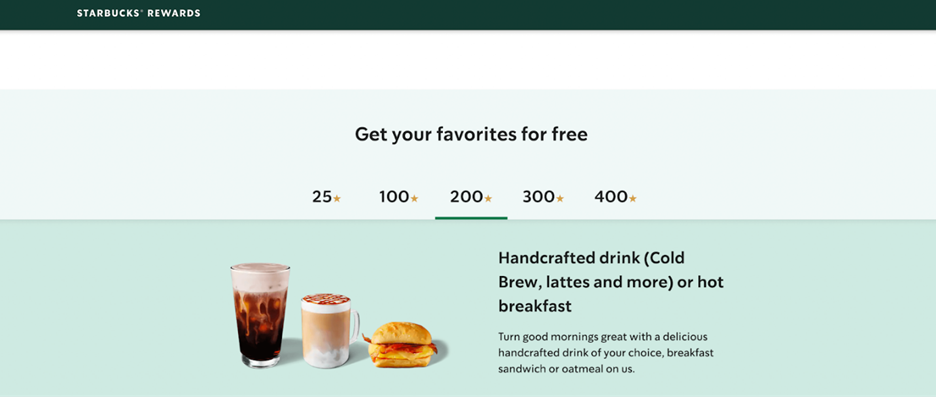

For example: Starbucks’ Rewards Program

Starbucks has a highly successful customer rewards program. They occasionally send out surveys to their loyalty program members, offering them the chance to earn bonus stars (which can be redeemed for free drinks and food items) in exchange for completing the survey. This incentive encourages customers to take the time to provide feedback, increasing the response rate.

3. Mobile optimization and convenience

In today's mobile-centric world, it's crucial to optimize your surveys for mobile devices. Ensure that your survey design is responsive and user-friendly on various screen sizes. Many people access surveys on smartphones and tablets, so a mobile-optimized experience is essential.

Keep surveys concise and straightforward, ideally taking no longer than 5-10 minutes to complete. Implement features like progress bars to show respondents how far they are into the survey and how much time remains, improving the overall convenience and user experience.

4. Social proof and trust-building

Building trust with survey participants is paramount. Incorporate elements of social proof by sharing testimonials or reviews from previous respondents who have found value in participating.

This demonstrates the legitimacy and credibility of your surveys. Additionally, clearly communicate your commitment to data privacy and anonymity. Reassure participants that their information will be kept confidential and used solely for research purposes. Design your surveys with a clean and professional appearance to further instill confidence in respondents.

Yelp, a popular review platform, effectively uses social proof to encourage user-generated content. They display the number of reviews, photos, and check-ins for each business. They also have a "Yelp Elite Squad" program that recognizes and rewards active and trusted reviewers. This approach fosters a sense of community and trust, prompting more users to participate by leaving reviews and completing surveys.

5. Multi-channel engagement

Diversify your approach to engage a broader audience. Promote your surveys through various channels, including email, social media, website banners, and even physical flyers or in-store signage if applicable.

Timing is also crucial; experiment with different times and days to send survey invitations to maximize reach and engagement. Don't hesitate to send gentle reminders to those who haven't responded yet, but do so tactfully to avoid being perceived as spammy.

By utilizing multiple touchpoints and outreach strategies, you can increase the visibility of your survey and improve response rates

In 2024, TrendPulse, a market research firm, sought to understand Gen Z's shopping habits. To achieve this, they implemented a mobile-first survey strategy, distributing surveys through SMS, social media ads, and in-app notifications. As an incentive, participants were offered a chance to win concert tickets. This approach resulted in a response rate nearly double that of their previous email-only surveys, providing more diverse and representative insights into Gen Z's preferences.

6. Transparency and communication

Maintaining transparency throughout the survey process is vital. Clearly communicate the purpose of your survey, how the data will be used, and the expected benefits for participants. Address any concerns about data privacy and anonymity upfront. Establish trust by being open and honest, which can encourage more people to participate.

A notable example of a company embracing transparency in customer feedback is Stripe. In 2025, Stripe's CEO, Patrick Collison, implemented a unique approach by inviting customers to participate directly in the company's bi-weekly leadership meetings. During the first 30 minutes of these sessions, a customer shares candid feedback about their experience with Stripe's services, providing real-time insights to approximately 40 top managers.

This practice exemplifies how transparent and direct engagement with customers can lead to valuable insights and strengthen the relationship between a company and its clientele.

7. Gamification and interactive surveys

Incorporating gamification elements into your surveys can make them more engaging. Create interactive survey experiences with elements like quizzes, polls, or challenges. Offer rewards or recognition for completing certain milestones within the survey.

Gamified surveys not only capture respondents' attention but also make the process more enjoyable, resulting in higher response rates.

McDonald's runs a popular Monopoly promotion where customers receive game pieces with their purchases. These pieces often include survey codes that customers can enter online for a chance to win prizes. By integrating surveys into a gamified experience, McDonald's encourages customers to participate in surveys, thereby increasing their response rates.

Another amazing example is: Microsoft Rewards

Microsoft Rewards is a program that incentivizes users to engage with Microsoft products and services. Users can earn points for completing tasks, including taking surveys. These points can be redeemed for a variety of rewards, such as gift cards or Xbox subscriptions. Microsoft's gamified approach not only boosts survey response rates but also enhances user engagement with their ecosystem.

8. Timing and frequency management

The timing of your survey invitations can significantly impact response rates. Send survey invitations at times when your audience is most likely to be available and receptive.

Avoid over-surveying your audience by carefully managing the frequency of survey requests. Bombarding respondents with surveys can lead to survey fatigue and reduced participation.

SurveyMonkey, a leading survey software platform, introduced "One-Question Surveys" as a way to reduce survey fatigue and increase response rates. Instead of sending long surveys, they send single, concise questions at the right moments. This approach respects the users' time and attention, resulting in higher response rates and more actionable insights.

9. Feedback loop and actionable insights

Show your commitment to making meaningful changes based on survey feedback. Communicate how survey responses will be used to improve products, services, or processes. Share previous survey-driven improvements as a demonstration of your commitment.

When respondents see that their input leads to positive changes, they are more likely to participate in future surveys.

Apple provides iOS users with a built-in Feedback app that allows them to submit comments, suggestions, and bug reports directly to Apple's development team. What sets this apart is that Apple often responds to user feedback with updates and fixes. This feedback loop demonstrates that user input is valued and acted upon, encouraging more users to provide feedback.

Another amazing example is Uber's "Driver Advisory Council":

Uber established a "Driver Advisory Council" where they regularly meet with a group of drivers to discuss concerns and improvements. This initiative gives drivers a direct voice in the company's decision-making process. By actively involving drivers in shaping the platform, Uber increases their survey response rates and fosters a sense of ownership and loyalty among their driver-partners.

10. Surprise and delight campaigns

Surprise and delight campaigns can be a fun and effective way to incentivize survey participation. Randomly select respondents to receive unexpected rewards, exclusive offers, or personalized thank-you messages. These surprise elements can create a positive association with your surveys, increasing the likelihood of participation and a positive response.

11. Community engagement and user forums

Building a sense of community around your brand or product can foster a culture of participation. Establish user forums or online communities where customers can discuss their experiences and provide feedback.

Encourage forum members to participate in surveys by emphasizing their role in shaping the brand or product's future. Engaging with a passionate user community can yield valuable insights and higher survey response rates.

Reddit's "Ask Me Anything" (AMA) sessions are a unique way to engage with users and gather feedback. Celebrities, experts, and even company representatives host AMAs, where they answer questions and engage in discussions with the Reddit community.

Companies can use a similar approach to host open forums or Q&A sessions where they invite users to ask questions and provide feedback. These interactive sessions can generate valuable insights and encourage users to participate in surveys and discussions.

12. Collaborative product development

Involve your audience in the product development process. Seek their input on new features, designs, or innovations. When respondents feel that their opinions directly influence the products or services they use, they are more likely to engage in surveys related to these topics.

Collaborative product development boosts response rates and fosters a sense of ownership and loyalty among participants.

LEGO's "Ideas" platform allows fans to submit their own designs for potential LEGO sets. Users can vote on their favorite designs, and if a design receives enough votes, LEGO considers producing it as an official set. This collaborative approach engages the LEGO community and serves as a form of feedback collection.

Users actively provide input on which sets should be made, leading to high engagement and a strong sense of ownership. Brands in various industries can implement similar platforms or campaigns involving customers in product development, encouraging them to provide feedback through surveys and voting mechanisms.

13. Audio and voice surveys

Audio and voice surveys are innovative tools that gather feedback through spoken responses. They offer inclusivity for diverse demographics, foster natural conversations, and enable multilingual capabilities. These surveys engage respondents effectively, making them ideal for gathering real-time insights, customer satisfaction assessments, and political polling.

A notable example of a company implementing audio or voice surveys is Fiserv, a leading financial technology firm. They integrated conversational AI into their customer feedback process to enhance the quality of responses. By transforming traditional surveys into dynamic, two-way conversations, Fiserv's AI system could ask adaptive follow-up questions, leading to more detailed and actionable insights. This approach resulted in a 10-point increase in Net Promoter Scores (NPS) across several customer touchpoints, translating into improved client retention and significant revenue gains.

How rewards and incentives can overcome survey fatigue and boost response rates

A study revealed that surveys offering incentives saw a 30% increase in survey completion rates compared to those without. Another study by Survey Sparrow found that a mere $5 incentive boosted response rates by 33%. These numbers translate to a clear message: rewards work! They incentivize participation, show appreciation, and subtly communicate the value you place on respondents' time and opinions.

The "lollipop after the dentist" scenario isn't just a childhood experience; it's a universal truth: incentives, rewards, and recognition have a well-documented power to motivate and influence behavior. From the employee receiving a bonus for exceeding goals to the customer earning points for completing a survey, positive reinforcement plays a significant role in various aspects of our lives.

The success of incentives lies in their ability to tap into fundamental human motivators. Rewards signal appreciation, reinforcing desired behaviors and encouraging repetition. They can also introduce an element of fun and competition, sparking engagement and motivating participation.

Why rewards work

- They value time: Let's face it, our time is precious. Rewards acknowledge this value and offer an incentive for respondents to invest their minutes in your survey.

- Motivation matters: Rewards inject a dose of motivation, transforming a mundane task into an opportunity for potential gain.

- Positive reinforcement: Completing a survey with a reward attached creates a positive association, making respondents more likely to participate in future surveys.

- Increased engagement: Rewards can keep respondents engaged throughout the survey, leading to higher completion rates and more reliable data.

Choosing the right rewards to boost survey response rates

When it comes to increasing survey response rates, one size definitely does not fit all. The most effective reward systems are those that are tailored to the audience's preferences and aligned with your survey goals. From instant gratification to long-term engagement, the right incentive can transform your survey from a task into a rewarding experience. Below is a guide to the kinds of rewards and incentives that can be leveraged to motivate participation and maximize completion rates.

1. Discounts

Offer participants a discount on your product or service as a direct thank-you for completing the survey. This is particularly effective for customer feedback surveys where the respondent already has a relationship with your brand. It not only encourages responses but can also drive future purchases.

2. Donations

For socially conscious audiences, a charitable donation made on behalf of the respondent can be a powerful motivator. You can partner with a non-profit and donate a small amount for each completed survey. This creates goodwill while still supporting your feedback goals.

3. Sweepstakes entries

Inject an element of excitement by offering entries into a prize draw. Whether it’s a tech gadget, a luxury item, or a popular gift card, sweepstakes are great for short-term campaigns or when you want to rapidly boost participation. Just ensure the prize resonates with your audience.

4. Early access to features or products

Incentivize feedback by offering participants a sneak peek at new products or beta features. This appeals especially to brand loyalists and early adopters who appreciate being part of a brand’s innovation journey.

5. Points-based programs

A flexible and engaging reward system, points programs allow respondents to accumulate points with each survey they complete. These can later be redeemed for a variety of rewards—such as merchandise, dining experiences, travel perks, or even charitable contributions. This system is ideal for building ongoing engagement across multiple survey touchpoints.

6. Cash incentives

Nothing motivates quite like money. Offering direct cash rewards can be especially effective in B2B or research-heavy environments where the time investment is significant. However, it's important to strike the right balance—cash may not always foster long-term engagement or brand loyalty.

7. E-gift cards

E-gift cards strike a sweet spot between flexibility and personalization. They offer instant delivery, minimal logistical friction, and the freedom to choose from a wide array of retailers or experiences. These are especially useful in global campaigns where physical rewards may be challenging to distribute. You can offer a range of gift cards—retail, dining, wellness, entertainment, or even travel—to ensure appeal across demographics.

Crafting your winning reward strategy. Here's a roadmap

- Define your survey goals and target audience. What insights do you seek? Who are you trying to reach?

- Research and tailor your rewards. What motivates your target audience? Cash, donations, or gamification?

- Set a clear budget and communication plan. How much can you afford, and how will you communicate the rewards?

- Track and analyze your results. Did the rewards boost participation? Which types resonated best? Use data to refine your strategy for future surveys.

Kantar automates reward distribution with Plum

Challenge:

Kantar, a leading market research company, faced challenges with their traditional reward distribution process. It was manual, time-consuming, and inefficient, requiring researchers and business teams to spend valuable time on procurement and distribution instead of core tasks.

Additionally, the pandemic shifted Kantar's focus to online participants, requiring a solution for instant rewards.

Solution:

Kantar implemented Plum, a rewards and incentives platform, to automate their reward distribution process.

- Automation: Plum automated the entire reward distribution process, from selection to delivery, saving Kantar significant time and resources.

- Instant rewards: With Plum, Kantar could offer instant rewards to online participants, increasing engagement and completion rates.

- Seamless integration: Plum integrated seamlessly with Kantar's existing systems, ensuring a smooth transition and minimal disruption to workflows.

- Global reach: Plum offered a wide range of global reward options, catering to Kantar's diverse participant base.

- Reduced costs: Plum’s efficient platform and competitive pricing helped Kantar reduce their overall reward program costs.

Results:

- Increased efficiency: Kantar's researchers and business teams saw a significant increase in efficiency, allowing them to focus on core tasks like research and analysis.

- Improved engagement: Instant rewards led to increased engagement and participation from online participants, resulting in more valuable data for Kantar. Plum delivered more than 3.32 million USD in rewards in just a quarter and 243% growth in rewards distributed over two quarters

- Reduced costs: Kantar achieved cost savings through Plum’s efficient platform and competitive pricing.

- Faster implementation: Kantar implemented Plum in just 72 hours, without affecting their existing processes.

Streamline rewards with the power of automation

Kantar’s success with Plum illustrates how automating rewards can dramatically improve efficiency, reduce costs, and elevate user engagement. Whether you’re managing research surveys, sales incentives, or customer campaigns, Xoxoday Plum offers a scalable, tech-friendly solution with seamless integrations, omnichannel delivery, and a global reward catalog.

Schedule a demo with Xoxoday Plum and unlock a smarter, faster, and more impactful way to reward.