Aumentare il tasso di risposta ai sondaggi con i premi

Scoprite quali sono le cause di un basso tasso di risposta alle indagini e come superarle. Questo blog illustra le principali sfide, le soluzioni pratiche e le migliori pratiche di indagine che migliorano il tasso di completamento dell'indagine e aiutano a raccogliere informazioni più accurate e fruibili.

In questa pagina

- Che cos'è il tasso di risposta di un sondaggio?

- Come si calcola il tasso di risposta di un sondaggio?

- I motivi principali per cui i rispondenti ignorano i sondaggi

- 16 Migliori pratiche per la conduzione dei sondaggi

- 13 suggerimenti per aumentare i tassi di risposta ai sondaggi

- Come i premi e gli incentivi possono superare la stanchezza da sondaggio e aumentare i tassi di risposta

- Scegliere i premi giusti per aumentare i tassi di risposta ai sondaggi

- Creare una strategia vincente per i premi. Ecco una tabella di marcia

- Kantar automatizza la distribuzione dei premi con Plum

Vi è mai capitato di impegnarvi al massimo nella realizzazione di un sondaggio, per poi ritrovarvi in silenzio? Questo non è solo frustrante, ma segnala un problema più grande: la stanchezza da sondaggio. Nel mondo di oggi, le persone sono inondate di richieste di feedback, che portano al disinteresse e all'apatia. Le conseguenze? Dati incompleti, approfondimenti imprecisi e decisioni sbagliate dettate da un feedback non rappresentativo.

Immaginate di lanciare un prodotto basandovi su risposte distorte, trascurando i principali punti dolenti o interpretando male il sentimento del pubblico. Il costo di ignorare la fatica dei sondaggi può essere significativo: danneggia le decisioni aziendali, le relazioni con i clienti e la credibilità.

In questo blog esploreremo le otto ragioni principali alla base del basso coinvolgimento nei sondaggi e condivideremo le soluzioni praticabili per aumentare i tassi di completamento e la qualità delle risposte.

Perché i sondaggi sono importanti? Perché offrono una linea diretta con le menti e le motivazioni del vostro pubblico. Che si tratti di marketing, risorse umane o politiche pubbliche, i sondaggi guidano le decisioni migliori, dando forma ai prodotti, migliorando il coinvolgimento dei dipendenti e allineando le strategie alle esigenze del mondo reale.

Che cos'è il tasso di risposta di un sondaggio?

Un sondaggio ha probabilmente successo in base alla maggiore risposta che riceve. Il tasso di risposta è la percentuale di persone che hanno partecipato al sondaggio rispetto alla percentuale di persone che lo hanno visualizzato. Non tutti coloro che visualizzano o iniziano un sondaggio lo completano. Ciò può essere dovuto a varie ragioni che devono essere corrette con strategie efficaci per ottenere un buon tasso di risposta.

Come si calcola il tasso di risposta di un sondaggio?

Il tasso di risposta al sondaggio si calcola dividendo il numero di persone che hanno completato il sondaggio per il numero di persone che sono state invitate o indirizzate a partecipare al sondaggio. Il risultato viene poi moltiplicato per 100 per esprimere il valore in percentuale.

N. di risposte ricevute

__________________________________ X 100

N. totale di persone a cui è stato inviato il sondaggio

Ad esempio, se avete inviato il sondaggio a 400 persone e le risposte ricevute sono state 120, il tasso di risposta sarà (120/400) X 100 = 30%.

Un buon tasso di risposta per i sondaggi è del 40-50%. Le organizzazioni devono pianificare il sondaggio in modo da raggiungere un buon tasso. Altrimenti, non si risolve lo scopo del sondaggio.

Non sempre si raggiunge un buon tasso perché le organizzazioni non seguono alcune strategie efficaci.

I motivi principali per cui i rispondenti ignorano i sondaggi

Ammettiamolo, ottenere tassi di completamento dei sondaggi può essere difficile. Capire perché i rispondenti scelgono di ignorarli è fondamentale per massimizzare le possibilità di coinvolgimento.

Ecco alcuni motivi per cui gli intervistati premono il tasto "cancella":

1. Il tempo

Nel nostro mondo frenetico, ogni minuto è importante. Se il sondaggio viene percepito come troppo lungo o dispendioso in termini di tempo, i rispondenti probabilmente daranno la priorità ad altre attività. Puntate sulla brevità e su una chiara stima del tempo di completamento. Uno studio di SurveyMonkey ha rilevato che le indagini che superano i 7-8 minuti registrano un calo dal 5% al 20% nei tassi di completamento delle indagini.

2. Lo sforzo

Le domande sono confuse, ripetitive o richiedono una digitazione eccessiva? Ogni ostacolo aumenta lo sforzo richiesto, creando attrito e scoraggiando il completamento del sondaggio. Optate per domande chiare e concise con opzioni di risposta in linea con il vostro pubblico di riferimento. Rientrano in questa categoria anche i sondaggi "non amichevoli per l'utente", che presentano una UX scadente e rendono la navigazione dei passaggi una "sofferenza".

3. La rilevanza

Se i rispondenti non vedono il collegamento tra l'argomento del sondaggio e i loro interessi o esperienze, si sentiranno indifferenti. Anche se l'argomento è in linea con la loro vita, dovete fare uno sforzo in più per assicurarvi che le domande siano intelligenti, non offensive e non vadano contro protocolli, cause e norme. Adattate il vostro sondaggio a specifici dati demografici o comportamenti per garantire la pertinenza e catturare un feedback autentico.

4. Stanchezza da sondaggio

Immaginate di camminare per strada bombardati da venditori che propongono diversi sondaggi. Ecco cosa si prova oggi per molti intervistati. Siamo bombardati da sondaggi online e offline. La partecipazione costante porta alla stanchezza e all'apatia nei confronti dei sondaggi. Limitate la frequenza, variate l'approccio e offrite incentivi interessanti per combattere la stanchezza e aumentare i tassi di risposta.

5. La trasparenza

I sondaggi poco trasparenti fanno scattare l'allarme. Siate trasparenti sullo scopo del sondaggio, su chi lo sta conducendo e su come verranno utilizzati i dati. Questo crea fiducia e incoraggia la partecipazione.

6. Interesse

Le vostre domande sono aride e prevedibili? Aggiungete creatività e curiosità per stimolare la curiosità e motivare gli intervistati a impegnarsi. Considerate elementi visivi, formati interattivi o domande personalizzate.

7. Tempistica

L'invio di sondaggi in orari scomodi è una ricetta per il disimpegno. Considerate i fusi orari, le norme culturali e i dati demografici dei destinatari per ottimizzare i tempi di consegna e massimizzare la visibilità. Utilizzate le analisi per capire il comportamento online, le caratteristiche culturali e i modelli di vita lavorativa per mettere a punto la vostra strategia temporale. Uno studio mostra che il tasso di completamento più alto per le indagini più brevi si registra il lunedì (18%).

8. Motivazione

Perché i partecipanti dovrebbero investire il loro tempo? Comunicate chiaramente il valore della loro partecipazione e sottolineate l'impatto positivo che il loro feedback può avere. Considerate la possibilità di offrire incentivi o di rendere l'esperienza un gioco per motivare ulteriormente l'impegno. Tra tutti gli intervistati, ⅓ di loro cita l'ottenimento di ricompense o premi come motivazione principale.

16 Migliori pratiche per la conduzione dei sondaggi

Ecco 16 best practice per la conduzione di sondaggi che dovete conoscere per condurre un sondaggio di successo.

1. Farli sentire speciali

Iniziate dicendo ai rispondenti che apprezzate sinceramente il tempo e lo sforzo che hanno fatto per partecipare al sondaggio. Completate questo pensiero aggiungendo che le loro opinioni sono preziose per il successo del vostro progetto.

Dopo un'attenta selezione e considerazione, se li avete scelti, fate leva sul fatto che fanno parte di un gruppo esclusivo e selezionato a cui è destinato questo sondaggio.

Esprimete la vostra gratitudine: un breve messaggio dopo ogni tre domande può essere molto efficace, seguito da uno più approfondito alla fine del sondaggio.

2. Restringere gli obiettivi

Restringete la vostra attenzione all'obiettivo o agli obiettivi esatti che state cercando di raggiungere. Limitate gli obiettivi critici al minor numero possibile.

In questo modo, non solo sarete in grado di indagare più a fondo in ogni area (e di sottrarre meno tempo al vostro intervistato), ma otterrete anche dati più "significativi" e più facili da gestire.

La "sindrome della ruota cigolante" si riferisce all'attribuzione di maggiore importanza alle domande che si trovano in primo piano o in cima ai pensieri.

Tuttavia, questo potrebbe rendere il sondaggio sbilenco o distorto. Cercate di avere un giusto equilibrio di domande che coprano tutti gli aspetti e le prospettive rilevanti, in modo che i risultati siano imparziali e validi.

3. Attenzione agli errori di campionamento

Assicuratevi che la selezione del vostro "gruppo di interesse" sia corretta e imparziale. Se volete fare un sondaggio sulle abitudini alimentari dei bambini, non spedite la posta ai single. Se volete un feedback sulla vostra nuova griglia per la carne, non condividete il sondaggio con i vegani. L'idea è chiara.

I sottogruppi all'interno della popolazione, ad esempio, possono "alterare" i risultati e renderli "non generalizzabili", poiché includono l'opinione di persone che non fanno parte del vostro "focus group".

Per garantire che il questionario raggiunga le persone adatte e rilevanti per il vostro studio, inviatelo a piccoli gruppi di persone in diverse aree geografiche.

L'altra "soluzione" è quella di sovracampionare per coprire il più possibile i dati demografici giusti. Tuttavia, gli errori di campionamento sono un problema ostinato nel "paese dei sondaggi" e, sebbene sia possibile ridurli al minimo, potrebbe non essere possibile eliminarli.

4. Mantenere l'equilibrio ed evitare la sindrome della ruota che scricchiola

La "sindrome della ruota cigolante" si riferisce alla pratica di dare maggiore importanza alle domande che sono in primo piano o in cima ai pensieri.

Tuttavia, questo potrebbe rendere il sondaggio sbilenco o distorto. Cercate di avere un giusto equilibrio di domande che coprano tutti gli aspetti e le prospettive rilevanti, in modo che i risultati siano imparziali e validi.

5. Non andare troppo sul personale

Non andate troppo sul personale con le vostre domande. I dati demografici come l'età, il sesso, l'ubicazione e altri saranno già presenti, quindi le domande su questi aspetti non faranno altro che far sembrare il vostro sondaggio poco professionale.

Indagare sui dettagli personali e professionali può rendere il vostro database più granulare, ma potrebbe far arrabbiare l'utente. La cosa migliore è trattare la via di mezzo, fornendo solo le informazioni necessarie.

6. Mantenere la semplicità e la logica.

Progettate le domande in modo tale che l'intervistato possa rispondere:

- Può rispondere alle domande in qualsiasi ordine o modo, a meno che non ci sia una buona ragione dietro la sequenza progettata.

- Non ha fretta di completare il questionario entro un termine prestabilito (o, peggio, un orologio che scorre).

- Non è costretto ad aprire un dizionario per ogni 6° parola: assicuratevi che il sondaggio non sia infarcito di parole ricercate, termini complicati o gergo industriale/commerciale.

- Ha la possibilità di saltare una domanda e passare alla successiva.

- Non è necessario "trovare la domanda nascosta nell'immagine", non si tratta di un gioco per bambini.

- Non create domande composte o stratificate (utilizzando elementi come "e", "o", "non", "tuttavia", "però", "allora", ecc.) Mantenete un tono chiaro, non offensivo e convincente.

7. Mantenere un tono breve e dolce

I sondaggi migliori sono stimolanti, non richiedono tempo. Inoltre, rispettano il tempo del rispondente. Riducete al minimo gli elementi visivi per evitare il disordine, coinvolgete i rispondenti con una voce calda e amichevole e resistete alla tentazione di riempire tutto.

Cercate di ridurre le domande a livello di strategia e a lungo termine (conservatele per un altro sondaggio) e di passare a domande a livello tattico per le azioni da intraprendere nei prossimi sei mesi.

8. Presupporre la familiarità con il soggetto è una cattiva idea.

Non date per scontato che l'intervistato abbia una conoscenza avanzata o esperta dell'argomento. Se state intervistando dei professionisti, dovete comunque tenere conto di limiti ragionevoli di familiarità (ricordate che se saltano la domanda, ci rimettete voi, non loro).

Fornite un modo semplice per accedere alle informazioni se hanno bisogno di maggiore chiarezza su una domanda. (potete fornire note a margine, note a piè di pagina o link a Google).

9. Domande di stimolo

"Abbiamo recentemente lanciato un prodotto di classe mondiale che aumenta la produttività, aiuta a risparmiare tempo e costi e ha ottenuto una valutazione del 95% su Amazon: se l'avete usato, vorremmo sapere cosa ne pensate", è una domanda di primo piano.

Una domanda guida contiene informazioni incorporate che, senza volerlo, condizionano la risposta. L'eliminazione dell'obiettività dall'equazione vi priva di ciò che avrebbe potuto essere un'intuizione genuina.

10. Limitare il numero di domande "aperte".

Le domande a risposta aperta si concentrano sulla raccolta di feedback qualitativi, a differenza delle domande con risposta affermativa o negativa, che sono quantificabili. . Richiedono una risposta descrittiva che fa riflettere l'intervistato e lo spinge a condividere i suoi sentimenti e le sue opinioni. Le domande a risposta aperta sono essenziali per le ricerche di mercato qualitative, perché forniscono approfondimenti e valori unici, che probabilmente non si sarebbero potuti ottenere con un formato "sì-no".

Tuttavia, avere troppe domande aperte può significare ritrovarsi con risme di testo da decifrare (soprattutto se si tratta di un sondaggio esteso), quindi limitatele a 2 o 3 e pianificate attentamente il tema e la formulazione per coprire tutti gli aspetti necessari.

11. Domande sull'intervallo di tempo per gli utenti

La maggior parte di noi odia essere vincolata a un impegno. Questo perché, il più delle volte, la verità si trova da qualche parte nella zona grigia tra il bianco e il nero.

In questi casi, un semplice Sì-No o un Accordo-Disaccordo non fornirà una visione accurata. Date all'intervistato ampi margini di manovra, come ad esempio una valutazione di tipo Impressionante > Buono > Ok > Cattivo > Terribile o una semplice valutazione da 1 a 5.

12. Mantenere il quadro di valutazione oggettivo (e coerente in tutto)

Le valutazioni sono potenziali zone d'ombra per due motivi. Possono indicare la "lettera" ma nascondere lo "spirito" (l'intenzione) della risposta. Per esempio, una valutazione di 7 può indicare un miglioramento rispetto a 6 o un peggioramento rispetto a 8, ma non c'è modo di sapere quale.

Non è sempre facile risolvere questo problema, poiché i temi specifici che sono soggettivi, per loro natura, non favoriscono una standardizzazione clinicamente "uniforme". Cercate di eliminare le zone d'ombra e di rendere la domanda il più possibile "di base".

13. Diffidare dei risultati duplicati

Se offrite un incentivo o una ricompensa, le persone potrebbero cercare di compilare lo stesso sondaggio con più voci per aumentare le possibilità di vincita (ad esempio, un'estrazione fortunata).

Affrontate questa sindrome comune aggiungendo un protocollo che vieti a chiunque di partecipare più di una volta.

14. Integrare la tecnologia

Le aziende SaaS come Plum, ad esempio, aiutano ad automatizzare l'intero processo, dagli strumenti configurabili e fai-da-te al controllo degli accessi attraverso le gerarchie, alla presenza omnicanale (i cellulari, ad esempio, consentono ai partecipanti di partecipare al sondaggio nel momento e nel luogo che preferiscono), ai report digitali e alle analisi azionabili.

15. Approfittate della "domanda successiva".

Il vostro sondaggio non deve necessariamente finire con il vostro sondaggio. Porre domande di follow-up vi aiuta a capire perché un partecipante ha risposto in un certo modo a un sondaggio e a portare alla luce preziose intuizioni che potrebbero esservi sfuggite "la prima volta".

Questa è l'occasione per approfondire aspetti importanti, chiarire risposte poco chiare o incoerenti (attraverso i dettagli o il contesto) e ottenere maggiori informazioni sui punti di vista che avete trovato interessanti (e che vale la pena approfondire).

Domande generali e aperte sul vostro prodotto, sui margini di miglioramento, sulla persona dei destinatari (emozioni, eventi e visioni che li influenzano) e, di fatto, sul sondaggio stesso: Quanto bene, o male, hanno pensato che fosse organizzato.

16. Rimanere in contatto

Trattate il vostro sondaggio come una porta d'accesso a un rapporto duraturo piuttosto che come un incontro una tantum. Ad esempio, mantenete la parola data se avete promesso loro un aggiornamento o un favore.

Se avete detto loro che il loro feedback significa molto per voi, dimostratelo condividendo i dettagli del suo impatto sul vostro progetto o sulla vostra attività.

Manteneteli "nel giro" condividendo di tanto in tanto notizie interessanti sul vostro percorso (ricordando loro che il loro sondaggio ha contribuito a formarlo), in modo da mantenere il vostro marchio e il vostro prodotto al centro dell'attenzione e alimentare i ponti per il sondaggio successivo.

13 suggerimenti per aumentare i tassi di risposta ai sondaggi

Ecco 13 consigli efficaci per aumentare i tassi di risposta ai sondaggi con esempi di marchi famosi:

1. Personalizzazione e targeting

La personalizzazione può aumentare notevolmente i tassi di risposta ai sondaggi. Iniziate a personalizzare gli inviti al sondaggio per renderli più coinvolgenti e pertinenti. Rivolgetevi ai destinatari con il loro nome e riconoscete eventuali interazioni o acquisti precedenti con il vostro marchio.

Considerate la possibilità di segmentare il pubblico in base a dati demografici, comportamento o altri fattori rilevanti. Adattando i contenuti del sondaggio agli interessi o alle esigenze specifiche di ciascun gruppo, farete sentire ai rispondenti che il loro contributo è prezioso, aumentando la probabilità di partecipazione.

Ad esempio: Raccomandazioni personalizzate di Netflix

Netflix è un esempio lampante di come la personalizzazione possa favorire il coinvolgimento degli utenti e i tassi di risposta ai sondaggi. Utilizza algoritmi sofisticati per analizzare le abitudini e le preferenze di visione degli utenti. Sulla base di questi dati, fornisce raccomandazioni di contenuti personalizzati a ciascun utente. Quando Netflix vuole raccogliere il feedback degli utenti, invia sondaggi personalizzati in base alla cronologia di visione e alle preferenze del singolo.

Ad esempio, se un utente guarda molti documentari, il sondaggio può concentrarsi sulle sue opinioni sulla selezione di documentari di Netflix. Questo approccio personalizzato aumenta la probabilità che gli utenti rispondano al sondaggio, perché è direttamente legato ai loro interessi.

2. Incentivi e premi

L'offerta di incentivi e premi può essere un potente motivatore per la partecipazione ai sondaggi. Premi tangibili come sconti, carte regalo o prodotti/servizi gratuiti in cambio del completamento di un sondaggio possono essere particolarmente efficaci.

In alternativa, si può creare eccitazione dando ai partecipanti la possibilità di vincere premi di valore attraverso un'estrazione casuale. Anche le ricompense non monetarie, come i contenuti esclusivi, l'accesso anticipato o i riconoscimenti, possono far leva su motivazioni diverse e incoraggiare tassi di risposta più elevati.

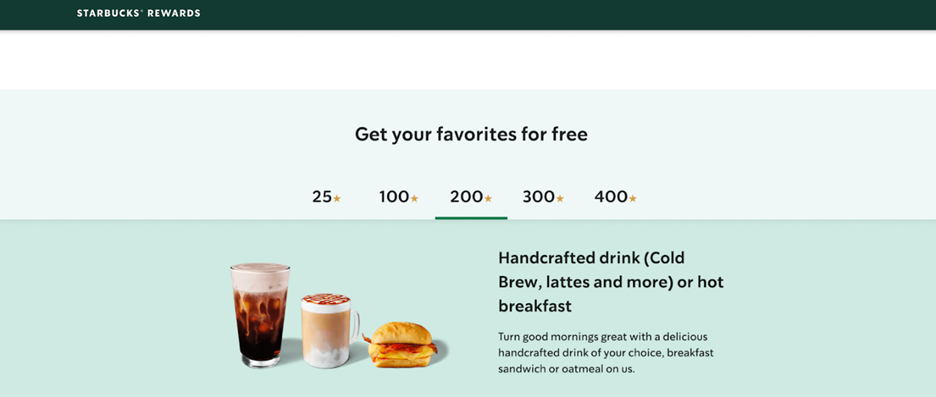

Per esempio: Programma Premi di Starbucks

Starbucks ha un programma di ricompensa per i clienti di grande successo. Di tanto in tanto invia sondaggi ai membri del programma fedeltà, offrendo loro la possibilità di guadagnare stelle bonus (che possono essere riscattate in cambio di bevande e cibi gratuiti) in cambio del completamento del sondaggio. Questo incentivo incoraggia i clienti a dedicare del tempo a fornire un feedback, aumentando il tasso di risposta.

3. Ottimizzazione e convenienza per i dispositivi mobili

Nell'attuale mondo incentrato sulla telefonia mobile, è fondamentale ottimizzare le indagini per i dispositivi mobili. Assicuratevi che il progetto dell'indagine sia reattivo e di facile utilizzo su schermi di varie dimensioni. Molte persone accedono alle indagini su smartphone e tablet, quindi un'esperienza ottimizzata per i dispositivi mobili è essenziale.

Mantenete i sondaggi concisi e semplici, che idealmente non richiedano più di 5-10 minuti per essere completati. Implementate funzioni come le barre di avanzamento per mostrare agli intervistati a che punto sono dell'indagine e quanto tempo rimane, migliorando la convenienza complessiva e l'esperienza dell'utente.

4. Prova sociale e costruzione della fiducia

Costruire la fiducia dei partecipanti al sondaggio è fondamentale. Incorporate elementi di riprova sociale condividendo testimonianze o recensioni di precedenti partecipanti che hanno trovato valore nella partecipazione.

Questo dimostra la legittimità e la credibilità dei vostri sondaggi. Inoltre, comunicate chiaramente il vostro impegno per la privacy e l'anonimato dei dati. Rassicurate i partecipanti sul fatto che le loro informazioni saranno mantenute riservate e utilizzate esclusivamente a fini di ricerca. Progettate le vostre indagini con un aspetto pulito e professionale per infondere ulteriore fiducia nei rispondenti.

Yelp, una popolare piattaforma di recensioni, utilizza efficacemente la riprova sociale per incoraggiare i contenuti generati dagli utenti. Mostra il numero di recensioni, foto e check-in per ogni attività. Inoltre, dispone di unprogramma "Yelp Elite Squad" che riconosce e premia i recensori attivi e affidabili. Questo approccio favorisce un senso di comunità e di fiducia, spingendo più utenti a partecipare lasciando recensioni e completando sondaggi.

5. Coinvolgimento multicanale

Diversificate il vostro approccio per coinvolgere un pubblico più ampio. Promuovete i vostri sondaggi attraverso vari canali, tra cui e-mail, social media, banner sul sito web e persino volantini fisici o insegne nei negozi, se applicabile.

Anche la tempistica è fondamentale; sperimentate orari e giorni diversi per inviare gli inviti al sondaggio per massimizzare la portata e il coinvolgimento. Non esitate a inviare gentili promemoria a coloro che non hanno ancora risposto, ma fatelo con tatto per evitare di essere percepiti come spammer.

Utilizzando più punti di contatto e strategie di sensibilizzazione, è possibile aumentare la visibilità dell'indagine e migliorare i tassi di risposta.

Nel 2024, TrendPulse, una società di ricerche di mercato, ha cercato di capire le abitudini di acquisto della Gen Z. A tal fine, ha implementato una strategia di sondaggio mobile-first, distribuendo i sondaggi tramite SMS, annunci sui social media e notifiche in-app. Come incentivo, ai partecipanti è stata offerta la possibilità di vincere biglietti per un concerto. Questo approccio ha portato a un tasso di risposta quasi doppio rispetto a quello dei precedenti sondaggi via e-mail, fornendo informazioni più diversificate e rappresentative sulle preferenze della generazione Z.

6. Trasparenza e comunicazione

È fondamentale mantenere la trasparenza durante l'intero processo di indagine. Comunicate chiaramente lo scopo del sondaggio, le modalità di utilizzo dei dati e i vantaggi previsti per i partecipanti. Rispondete in anticipo a qualsiasi dubbio sulla privacy e sull'anonimato dei dati. Stabilite la fiducia essendo aperti e onesti, il che può incoraggiare un maggior numero di persone a partecipare.

Un esempio notevole di azienda che ha abbracciato la trasparenza nel feedback dei clienti è Stripe. Nel 2025, l'amministratore delegato di Stripe, Patrick Collison, ha implementato un approccio unico invitando i clienti a partecipare direttamente alle riunioni bisettimanali della leadership dell'azienda. Durante i primi 30 minuti di queste sessioni, un cliente condivide un feedback sincero sulla propria esperienza con i servizi di Stripe, fornendo così approfondimenti in tempo reale a circa 40 top manager.

Questa pratica esemplifica come l'impegno trasparente e diretto con i clienti possa portare a preziosi approfondimenti e rafforzare il rapporto tra un'azienda e la sua clientela.

7. Gamification e sondaggi interattivi

Incorporare elementi di gamification nelle indagini può renderle più coinvolgenti. Create esperienze interattive con elementi come quiz, sondaggi o sfide. Offrite premi o riconoscimenti per il completamento di determinate tappe all'interno dell'indagine.

I sondaggi giocosi non solo catturano l'attenzione dei rispondenti, ma rendono anche il processo più piacevole, con conseguenti tassi di risposta più elevati.

McDonald's organizza una popolare promozione del Monopoly in cui i clienti ricevono pezzi di gioco con i loro acquisti. Questi pezzi spesso includono codici di sondaggio che i clienti possono inserire online per avere la possibilità di vincere dei premi. Integrando i sondaggi in un'esperienza di gioco, McDonald's incoraggia i clienti a partecipare ai sondaggi, aumentando così i tassi di risposta.

Un altro esempio sorprendente è: Microsoft Rewards

Microsoft Rewards è un programma che incentiva gli utenti a utilizzare i prodotti e i servizi Microsoft. Gli utenti possono guadagnare punti completando attività, tra cui la partecipazione a sondaggi. Questi punti possono essere riscattati per ottenere una serie di premi, come carte regalo o abbonamenti Xbox. L'approccio gamificato di Microsoft non solo aumenta i tassi di risposta ai sondaggi, ma migliora anche il coinvolgimento degli utenti nel loro ecosistema.

8. Gestione dei tempi e delle frequenze

La tempistica degli inviti al sondaggio può avere un impatto significativo sui tassi di risposta. Inviate gli inviti al sondaggio nei momenti in cui è più probabile che il vostro pubblico sia disponibile e ricettivo.

Evitate di sovraindagare il vostro pubblico gestendo con attenzione la frequenza delle richieste di sondaggio. Bombardare i rispondenti con sondaggi può portare a una stanchezza da sondaggio e a una riduzione della partecipazione.

SurveyMonkey, una piattaforma software leader nel settore delle indagini, ha introdotto le "Indagini a una domanda" come metodo per ridurre l'affaticamento da indagine e aumentare i tassi di risposta. Invece di inviare indagini lunghe, invia domande singole e concise al momento giusto. Questo approccio rispetta il tempo e l'attenzione degli utenti, con conseguenti tassi di risposta più elevati e maggiori informazioni utili.

9. Ciclo di feedback e approfondimenti praticabili

Mostrate il vostro impegno ad apportare cambiamenti significativi sulla base del feedback del sondaggio. Comunicate come le risposte al sondaggio saranno utilizzate per migliorare prodotti, servizi o processi. Condividete i miglioramenti ottenuti in passato grazie al sondaggio come dimostrazione del vostro impegno.

Quando gli intervistati vedono che il loro contributo porta a cambiamenti positivi, sono più propensi a partecipare alle indagini future.

Apple mette a disposizione degli utenti iOS un'app Feedback integrata che consente loro di inviare commenti, suggerimenti e segnalazioni di bug direttamente al team di sviluppo di Apple. Ciò che contraddistingue questa applicazione è che Apple risponde spesso ai commenti degli utenti con aggiornamenti e correzioni. Questo ciclo di feedback dimostra che i suggerimenti degli utenti sono apprezzati e presi in considerazione, incoraggiando così un maggior numero di utenti a fornire feedback.

Un altro esempio sorprendente è Il "Driver Advisory Council" di Uber:

Uber ha istituito un "Driver Advisory Council" in cui si riunisce regolarmente con un gruppo di autisti per discutere di problemi e miglioramenti. Questa iniziativa dà agli autisti una voce diretta nel processo decisionale dell'azienda. Coinvolgendo attivamente gli autisti nella creazione della piattaforma, Uber aumenta i tassi di risposta ai sondaggi e promuove un senso di appartenenza e di lealtà tra i suoi partner-autisti.

10. Campagne di sorpresa e delizia

Le campagne di sorpresa e delizia possono essere un modo divertente ed efficace per incentivare la partecipazione ai sondaggi. Selezionate a caso i rispondenti per ricevere premi inaspettati, offerte esclusive o messaggi di ringraziamento personalizzati. Questi elementi a sorpresa possono creare un'associazione positiva con le vostre indagini, aumentando la probabilità di partecipazione e di risposta positiva.

11. Coinvolgimento della comunità e forum degli utenti

Creare un senso di comunità intorno al vostro marchio o prodotto può favorire una cultura della partecipazione. Create forum di utenti o comunità online in cui i clienti possano discutere le loro esperienze e fornire feedback.

Incoraggiate i membri del forum a partecipare ai sondaggi sottolineando il loro ruolo nel plasmare il futuro del marchio o del prodotto. L'impegno di una comunità di utenti appassionati può produrre preziose intuizioni e tassi di risposta ai sondaggi più elevati.

Le sessioni "Ask Me Anything" (AMA) di Reddit sono un modo unico per coinvolgere gli utenti e raccogliere feedback. Celebrità, esperti e persino rappresentanti di aziende ospitano gli AMA, dove rispondono alle domande e si confrontano con la comunità di Reddit.

Le aziende possono utilizzare un approccio simile per ospitare forum aperti o sessioni di domande e risposte in cui invitano gli utenti a porre domande e fornire feedback. Queste sessioni interattive possono generare preziose intuizioni e incoraggiare gli utenti a partecipare a sondaggi e discussioni.

12. Sviluppo collaborativo del prodotto

Coinvolgete il vostro pubblico nel processo di sviluppo del prodotto. Chiedete il loro contributo su nuove funzionalità, design o innovazioni. Quando gli intervistati sentono che le loro opinioni influenzano direttamente i prodotti o i servizi che utilizzano, sono più propensi a partecipare ai sondaggi relativi a questi argomenti.

Lo sviluppo collaborativo del prodotto aumenta i tassi di risposta e promuove un senso di appartenenza e di fedeltà tra i partecipanti.

La piattaforma LEGO "Ideas" consente ai fan di presentare i propri progetti per potenziali set LEGO. Gli utenti possono votare i loro progetti preferiti e, se un progetto riceve un numero sufficiente di voti, LEGO prende in considerazione la possibilità di produrlo come set ufficiale. Questo approccio collaborativo coinvolge la comunità LEGO e funge da forma di raccolta di feedback.

Gli utenti danno attivamente il proprio contributo per la scelta dei set da realizzare, determinando un elevato coinvolgimento e un forte senso di appartenenza. I marchi di vari settori possono implementare piattaforme o campagne simili che coinvolgono i clienti nello sviluppo dei prodotti, incoraggiandoli a fornire un feedback attraverso sondaggi e meccanismi di voto.

13. Sondaggi audio e vocali

I sondaggi audio e vocali sono strumenti innovativi che raccolgono feedback attraverso risposte vocali. Offrono inclusione per diversi gruppi demografici, favoriscono conversazioni naturali e consentono funzionalità multilingue. Questi sondaggi coinvolgono efficacemente gli intervistati, rendendoli ideali per la raccolta di informazioni in tempo reale, la valutazione della soddisfazione dei clienti e i sondaggi politici.

Un esempio significativo di azienda che ha implementato sondaggi audio o vocali è Fiserv, un'azienda leader nel settore della tecnologia finanziaria. Ha integrato l'intelligenza artificiale conversazionale nel processo di feedback dei clienti per migliorare la qualità delle risposte. Trasformando i sondaggi tradizionali in conversazioni dinamiche e bidirezionali, il sistema di intelligenza artificiale di Fiserv è stato in grado di porre domande di follow-up adattive, che hanno permesso di ottenere approfondimenti più dettagliati e fruibili. Questo approccio ha portato a un aumento di 10 punti del Net Promoter Score (NPS) in diversi punti di contatto con i clienti, che si è tradotto in una maggiore fidelizzazione dei clienti e in un significativo aumento dei ricavi.

Come i premi e gli incentivi possono superare la stanchezza da sondaggio e aumentare i tassi di risposta

Uno studio ha rivelato che le indagini che offrivano incentivi hanno registrato un aumento del 30% nei tassi di completamento delle indagini rispetto a quelle che non ne offrivano. Un altro studio condotto da Survey Sparrow ha rilevato che un incentivo di soli 5 dollari ha aumentato i tassi di risposta del 33%. Questi numeri si traducono in un messaggio chiaro: i premi funzionano! Incentivano la partecipazione, mostrano apprezzamento e comunicano in modo sottile il valore che attribuite al tempo e alle opinioni dei rispondenti.

Lo scenario del "lecca-lecca dopo il dentista" non è solo un'esperienza infantile, ma una verità universale: incentivi, premi e riconoscimenti hanno un potere ben documentato di motivare e influenzare il comportamento. Dal dipendente che riceve un bonus per aver superato gli obiettivi al cliente che guadagna punti per aver completato un sondaggio, il rinforzo positivo gioca un ruolo significativo in vari aspetti della nostra vita.

Il successo degli incentivi risiede nella loro capacità di attingere alle motivazioni umane fondamentali. I premi segnalano l'apprezzamento, rafforzando i comportamenti desiderati e incoraggiando la ripetizione. Possono anche introdurre un elemento di divertimento e competizione, stimolando il coinvolgimento e motivando la partecipazione.

Perché i premi funzionano

- Danno valore al tempo: Ammettiamolo, il nostro tempo è prezioso. I premi riconoscono questo valore e offrono un incentivo ai rispondenti per investire i loro minuti nel vostro sondaggio.

- La motivazione è importante: Le ricompense conferiscono una dose di motivazione, trasformando un compito banale in un'opportunità di guadagno potenziale.

- Rinforzo positivo: Completare un sondaggio con un premio annesso crea un'associazione positiva, rendendo i rispondenti più propensi a partecipare a sondaggi futuri.

- Maggiore coinvolgimento: I premi possono mantenere gli intervistati impegnati per tutta la durata dell'indagine, portando a tassi di completamento più elevati e a dati più affidabili.

Scegliere i premi giusti per aumentare i tassi di risposta ai sondaggi

Quando si tratta di aumentare i tassi di risposta ai sondaggi, una taglia non va assolutamente bene per tutti. I sistemi di ricompensa più efficaci sono quelli adattati alle preferenze del pubblico e allineati agli obiettivi del sondaggio. Dalla gratificazione immediata al coinvolgimento a lungo termine, l'incentivo giusto può trasformare il sondaggio da un compito a un'esperienza gratificante. Di seguito una guida ai tipi di premi e incentivi che possono essere utilizzati per motivare la partecipazione e massimizzare i tassi di completamento.

1. Sconti

Offrite ai partecipanti uno sconto su un vostro prodotto o servizio come ringraziamento diretto per aver completato il sondaggio. Questa soluzione è particolarmente efficace per i sondaggi di feedback dei clienti che hanno già un rapporto con il vostro marchio. Non solo incoraggia le risposte, ma può anche spingere ad acquisti futuri.

2. Le donazioni

Per il pubblico socialmente consapevole, una donazione di beneficenza fatta per conto del rispondente può essere un potente motivatore. Potete collaborare con un'organizzazione no-profit e donare una piccola somma per ogni sondaggio completato. In questo modo si crea una buona volontà, sostenendo al tempo stesso i vostri obiettivi di feedback.

3. Partecipazioni a concorsi a premi

Per creare un elemento di eccitazione, offrite la possibilità di partecipare a un'estrazione a premi. Che si tratti di un gadget tecnologico, di un articolo di lusso o di una carta regalo popolare, i concorsi a premi sono ideali per le campagne a breve termine o quando si vuole aumentare rapidamente la partecipazione. Assicuratevi solo che il premio risuoni con il vostro pubblico.

4. Accesso anticipato a funzioni o prodotti

Incentivate il feedback offrendo ai partecipanti un'anteprima dei nuovi prodotti o delle funzionalità beta. Questo è particolarmente interessante per i fedelissimi del marchio e per gli early adopters, che apprezzano il fatto di far parte del percorso di innovazione di un marchio.

5. Programmi a punti

Un sistema di ricompensa flessibile e coinvolgente, i programmi a punti consentono agli intervistati di accumulare punti per ogni sondaggio completato. Questi possono poi essere riscattati per una serie di premi, come merce, esperienze culinarie, vantaggi di viaggio o persino contributi di beneficenza. Questo sistema è ideale per creare un coinvolgimento continuo su più punti di contatto dell'indagine.

6. Incentivi in denaro

Niente motiva come il denaro. L'offerta di premi diretti in denaro può essere particolarmente efficace in ambienti B2B o di ricerca, dove l'investimento di tempo è significativo. Tuttavia, è importante trovare il giusto equilibrio: il denaro non sempre favorisce l'impegno a lungo termine o la fedeltà al marchio.

7. Carte regalo elettroniche

Le carte regalo elettroniche sono un ottimo compromesso tra flessibilità e personalizzazione. Offrono una consegna immediata, un attrito logistico minimo e la libertà di scegliere tra un'ampia gamma di rivenditori o esperienze. Sono particolarmente utili nelle campagne globali, dove i premi fisici possono essere difficili da distribuire. È possibile offrire una gamma di carte regalo - al dettaglio, per la ristorazione, il benessere, l'intrattenimento o persino per i viaggi - per garantire un'attrattiva trasversale a tutte le fasce demografiche.

Creare una strategia vincente per i premi. Ecco una tabella di marcia

- Definite gli obiettivi del sondaggio e il pubblico di riferimento. Quali informazioni cercate? Chi state cercando di raggiungere?

- Ricercate e personalizzate i vostri premi. Cosa motiva il vostro pubblico di riferimento? Contanti, donazioni o gamification?

- Stabilite un budget chiaro e un piano di comunicazione. Quanto potete permettervi e come comunicherete le ricompense?

- Tracciate e analizzate i risultati. I premi hanno aumentato la partecipazione? Quali tipi di premi hanno avuto maggiore risonanza? Utilizzate i dati per perfezionare la vostra strategia per le indagini future.

Kantar automatizza la distribuzione dei premi con Plum

Sfida:

Kantar, azienda leader nel settore delle ricerche di mercato, si è trovata di fronte a problemi legati al tradizionale processo di distribuzione dei premi. Si trattava di un processo manuale, lungo e inefficiente, che richiedeva ai ricercatori e ai team aziendali di dedicare tempo prezioso all'approvvigionamento e alla distribuzione invece che alle attività principali.

Inoltre, la pandemia ha spostato l'attenzione di Kantar sui partecipanti online, richiedendo una soluzione per i premi istantanei.

Soluzione:

Kantar ha implementato Plum, una piattaforma di premi e incentivi, per automatizzare il processo di distribuzione dei premi.

- Automazione: Plum ha automatizzato l'intero processo di distribuzione dei premi, dalla selezione alla consegna, facendo risparmiare a Kantar tempo e risorse significative.

- Premi istantanei: Con Plum, Kantar può offrire ricompense istantanee ai partecipanti online, aumentando il coinvolgimento e i tassi di completamento.

- Integrazione perfetta: Plum si è integrato perfettamente con i sistemi esistenti di Kantar, garantendo una transizione fluida e un'interruzione minima dei flussi di lavoro.

- Portata globale: Plum ha offerto un'ampia gamma di opzioni di ricompensa a livello globale, per soddisfare la variegata base di partecipanti di Kantar.

- Riduzione dei costi: La piattaforma efficiente di Plum e i prezzi competitivi hanno aiutato Kantar a ridurre i costi complessivi del programma di ricompensa.

Risultati:

- Maggiore efficienza: I ricercatori e i team aziendali di Kantar hanno registrato un significativo aumento dell'efficienza, consentendo loro di concentrarsi su attività fondamentali come la ricerca e l'analisi.

- Miglioramento del coinvolgimento: Le ricompense istantanee hanno portato a un maggiore impegno e partecipazione da parte dei partecipanti online, con conseguente aumento dei dati di valore per Kantar. Plum ha consegnato più di 3,32 milioni di dollari in premi in un solo trimestre e una crescita del 243% dei premi distribuiti in due trimestri.

- Riduzione dei costi: Kantar ha ottenuto risparmi sui costi grazie all'efficiente piattaforma di Plum e ai prezzi competitivi.

- Implementazione più rapida: Kantar ha implementato Plum in sole 72 ore, senza intaccare i processi esistenti.

Semplificare i premi con la potenza dell'automazione

Il successo di Kantar con Plum illustra come l'automazione dei premi possa migliorare notevolmente l'efficienza, ridurre i costi e aumentare il coinvolgimento degli utenti. Sia che si tratti di gestire sondaggi di ricerca, incentivi alle vendite o campagne per i clienti, Xoxoday Plum offre una soluzione scalabile e facile da usare, con integrazioni perfette, consegna omnichannel e un catalogo globale di premi.

Programmate una demo con Xoxoday Plum e scoprite un modo più intelligente, veloce e d'impatto per premiare.